Topic 7 Linear Regression

Introduction

Introduction

Regression analysis is one of the most widely used tool in quantitative research which is used to analyse the relationship between variables.

One or more variables are considered to be explanatory variables, and the other is considered to be the dependent variable.

In general linear regression is used to predict a continuous dependent variable (regressand) from a number of independent variables (regressors) assuming that the relationship between the dependent and independent variables is linear.

If we have a dependent (or response) variable Y which is related to a predictor variables \(X_{i}\). The simple regression model is given by

\[\begin{equation} Y=\alpha+\beta X_{i}+\epsilon_{i} \tag{7.1} \end{equation}\]

R has the function \(\mathtt{lm}\) (linear model) for linear regression.

The main arguments to the function \(\mathtt{lm}\) are a formula and the data. \(\mathtt{lm}\) takes the defining model input as a formula

A formula object is also used in other statistical function like \(\mathtt{glm,\,nls,\,rq}\) etc, which is from a formula class.

7.1 Investment \(\beta\) using R (Single Index Model)

The ‘market model’ regression can be represented as the following regression.

\[\begin{equation} R_{i}=\alpha+\beta_{i}R_{M}+\epsilon \tag{7.2} \end{equation}\]

7.2 Data preprocessing

Download stock data using R’s quantmod package

Convert data to returns

Generate some descriptive statistics

Some plots

Data

# Run the following to download and save the data, this should be

# done once and when updating the time period

library(quantmod)

library(pander)

library(xts)

library(TTR)

# download stock

BHP = getSymbols("BHP.AX", from = "2019-01-01", to = "2021-07-31", auto.assign = FALSE)

# download index

ASX = getSymbols("^AXJO", from = "2019-01-01", to = "2021-07-31", auto.assign = FALSE)

# save both in rds (to be used in the TA chapter)

saveRDS(BHP, file = "data/bhp_prices.rds")

saveRDS(ASX, file = "data/asx200.rds")- Convert to returns

library(quantmod)

library(pander)

library(xts)

library(TTR)

# load data from the saved files (not required if we execute the

# chunk above)

BHP = readRDS("data/bhp_prices.rds")

ASX = readRDS("data/asx200.rds")

# using close prices

bhp2 = BHP$BHP.AX.Close

asx2 = ASX$AXJO.Close

# covert to returns

bhp_ret = dailyReturn(bhp2, type = "log")

asx_ret = dailyReturn(asx2, type = "log")

# merge the two with 'inner' join to get the same dates

data_lm1 = merge.xts(bhp_ret, asx_ret, join = "inner")

# convert to data frame

data_lm2 = data.frame(index(data_lm1), data_lm1$daily.returns, data_lm1$daily.returns.1)

# change column names

colnames(data_lm2) = c("Date", "bhp", "asx")

head(data_lm2) #there are row names which can be removed if required Date bhp asx

2019-01-02 2019-01-02 0.000000000 0.000000000

2019-01-03 2019-01-03 0.000000000 0.013510839

2019-01-04 2019-01-04 -0.008947241 -0.002488271

2019-01-07 2019-01-07 0.029808847 0.011289609

2019-01-08 2019-01-08 0.001162482 0.006873792

2019-01-09 2019-01-09 -0.003782952 0.009721207library(pastecs)

desc_stat1 = stat.desc(data_lm2[, 2:3], norm = TRUE)

pander(desc_stat1, caption = "Descriptive Statistics", split.table = Inf)| bhp | asx | |

|---|---|---|

| nbr.val | 653 | 653 |

| nbr.null | 9 | 1 |

| nbr.na | 0 | 0 |

| min | -0.1557 | -0.102 |

| max | 0.1128 | 0.06766 |

| range | 0.2685 | 0.1697 |

| sum | 0.4948 | 0.2853 |

| median | 0 | 0.001163 |

| mean | 0.0007577 | 0.0004369 |

| SE.mean | 0.0007444 | 0.0005075 |

| CI.mean.0.95 | 0.001462 | 0.0009966 |

| var | 0.0003618 | 0.0001682 |

| std.dev | 0.01902 | 0.01297 |

| coef.var | 25.1 | 29.69 |

| skewness | -0.4883 | -1.443 |

| skew.2SE | -2.553 | -7.546 |

| kurtosis | 9.991 | 13.32 |

| kurt.2SE | 26.16 | 34.86 |

| normtest.W | 0.9198 | 0.8266 |

| normtest.p | 3.885e-18 | 5.497e-26 |

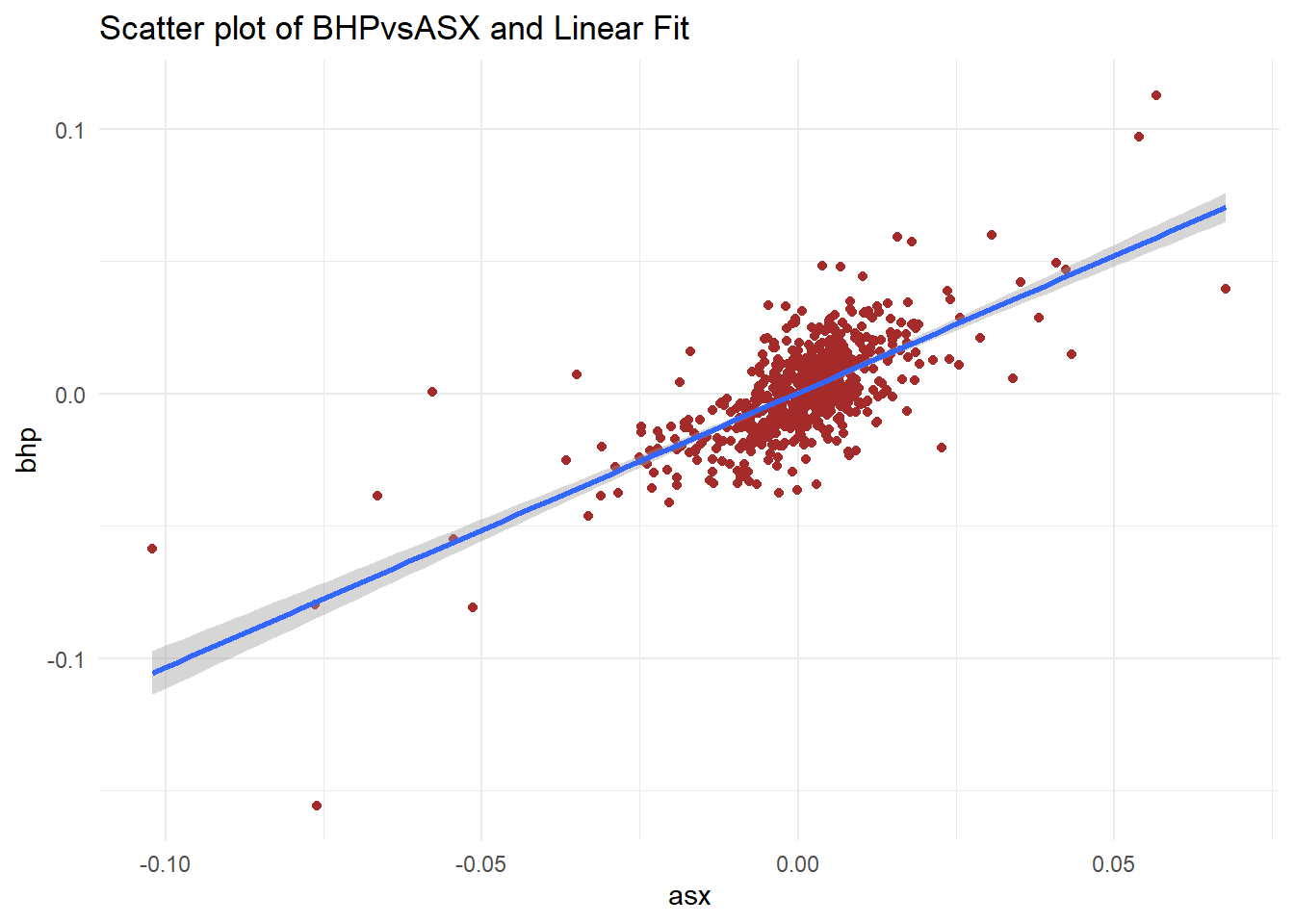

7.3 Visualisation

library(ggplot2)

library(tidyr)

p1 = ggplot(data_lm2, aes(asx, bhp))

p1 + geom_point(colour = "brown") + geom_smooth(method = "lm") + theme_minimal() +

labs(title = "Scatter plot of BHPvsASX and Linear Fit")

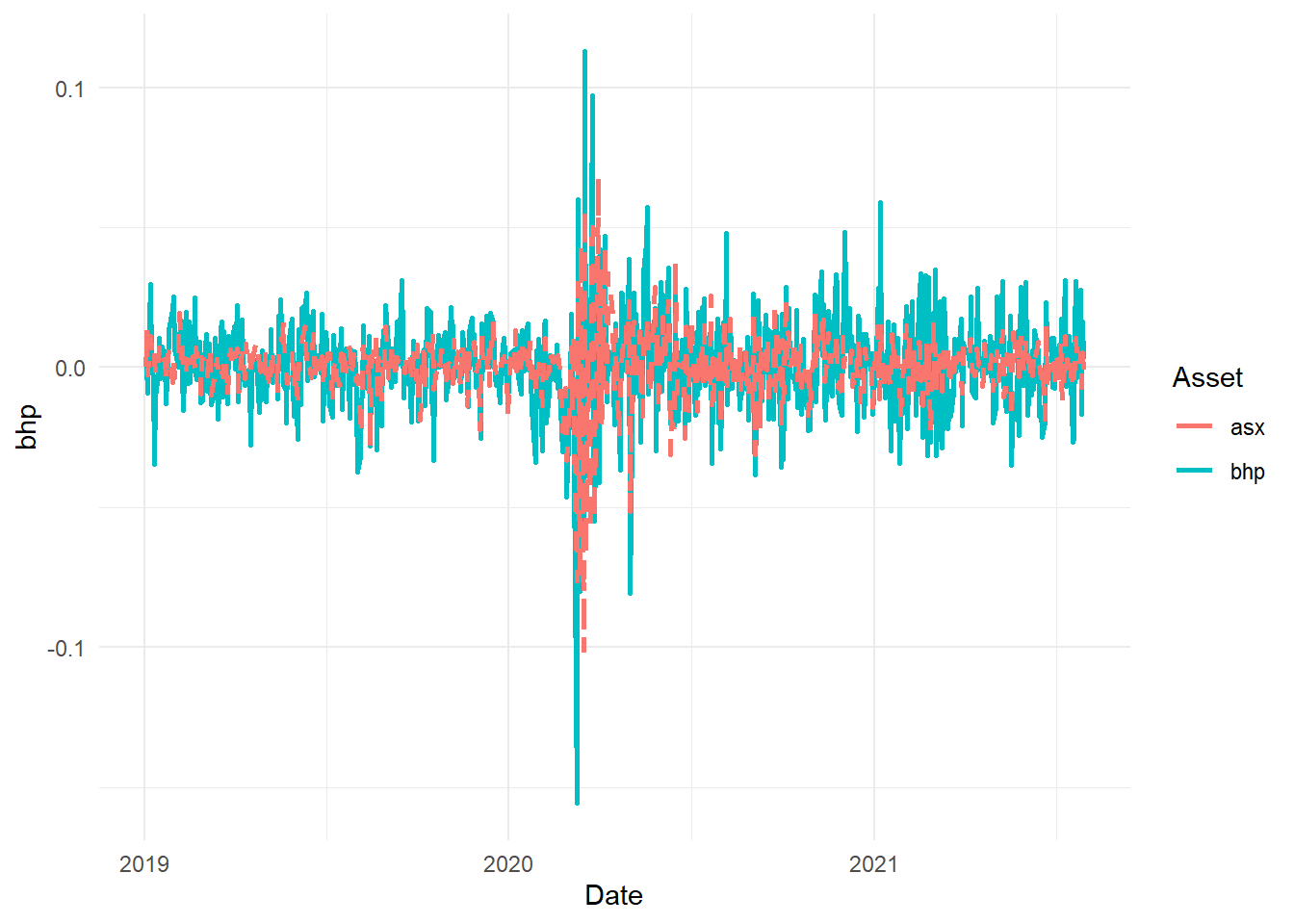

p2 = ggplot(data_lm2, aes(Date))

p2 + geom_line(aes(y = bhp, color = "bhp"), size = 1, lty = 1) + geom_line(aes(y = asx,

color = "asx"), size = 1, lty = 2) + scale_color_discrete("Asset") +

theme_minimal() + labs("Line Chart of Returns")

7.4 Regression analysis using lm

- Use lm to model the SIM

lreg1 = lm(formula = bhp ~ asx, data = data_lm2)

summary(lreg1) #to generate main results

Call:

lm(formula = bhp ~ asx, data = data_lm2)

Residuals:

Min 1Q Median 3Q Max

-0.077007 -0.008153 -0.000162 0.007500 0.060409

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0003046 0.0005270 0.578 0.564

asx 1.0372279 0.0406422 25.521 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01346 on 651 degrees of freedom

Multiple R-squared: 0.5001, Adjusted R-squared: 0.4994

F-statistic: 651.3 on 1 and 651 DF, p-value: < 2.2e-16pander(lreg1, add.significance.stars = T) #to tabulate| Estimate | Std. Error | t value | Pr(>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | 0.0003046 | 0.000527 | 0.5779 | 0.5635 | |

| asx | 1.037 | 0.04064 | 25.52 | 4.215e-100 | * * * |

- Using stargazer to print the output

library(stargazer)

stargazer(lreg1, type = "html", title = "Regression Results")| Dependent variable: | |

| bhp | |

| asx | 1.037*** |

| (0.041) | |

| Constant | 0.0003 |

| (0.001) | |

| Observations | 653 |

| R2 | 0.500 |

| Adjusted R2 | 0.499 |

| Residual Std. Error | 0.013 (df = 651) |

| F Statistic | 651.320*** (df = 1; 651) |

| Note: | p<0.1; p<0.05; p<0.01 |

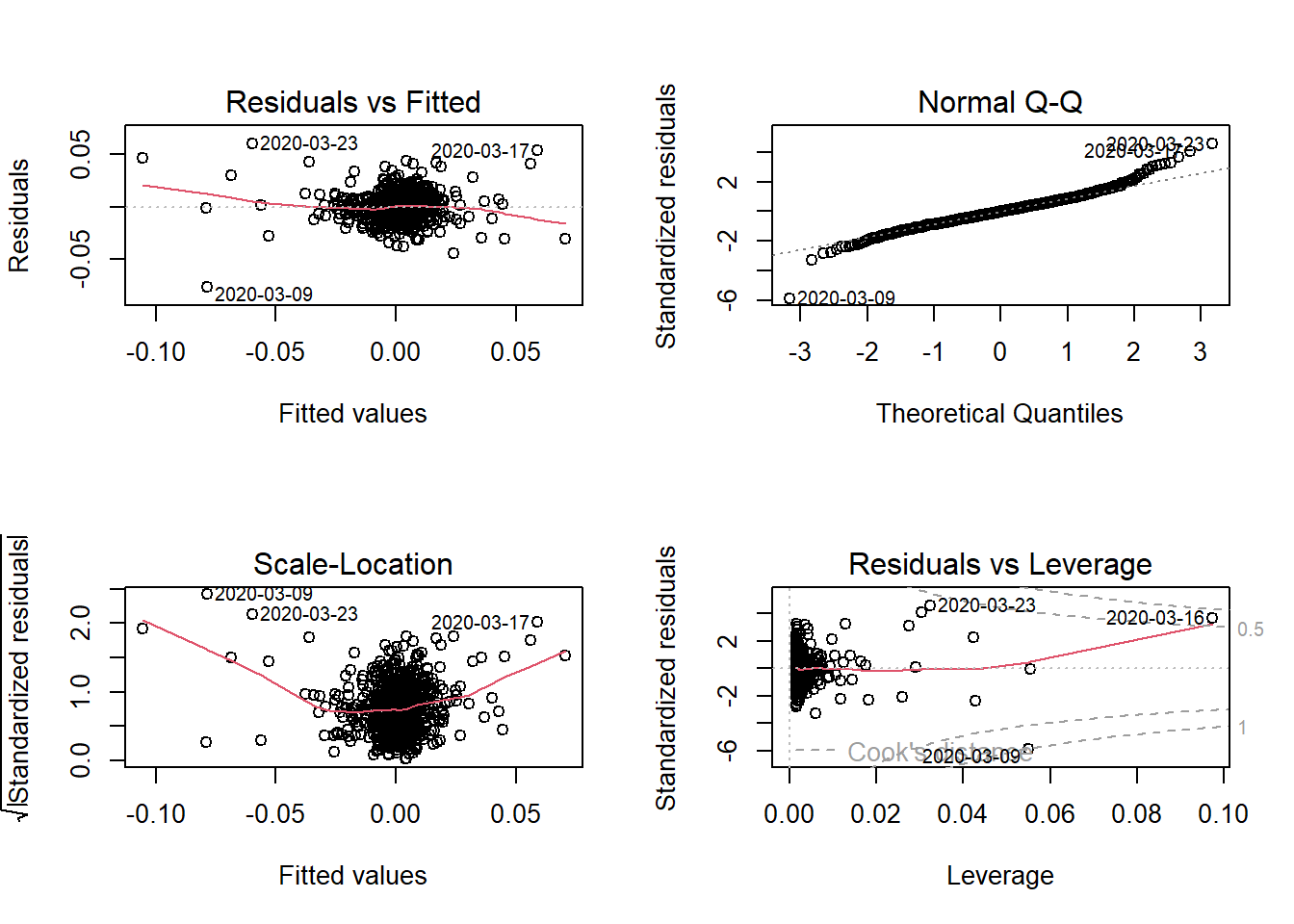

- Diagnostic Plots

par(mfrow = c(2, 2))

plot(lreg1)

Topic 8 Multiple Regression

- Multiple regression extends simple linear regression with more than one (1) predictor variables

- We have one response variable and multiple independent predictor variable.

\[\begin{equation} y_{i}=\alpha+\beta_{1}x_{1}+\beta_{2}x_{2}+\ldots+\varepsilon_{i} \tag{8.1} \end{equation}\]

- The estimation process is similar to the univariate case where the additional predictors are added with

+operator - A multifactor example demonstrates in the next section

8.1 Fama-French Three Factor Model

Fama & French (1992);Fama & French (1993) extended the basic CAPM to include size and book-to-market effects as explanatory factors in explaining the cross-section of stock returns.

SMB (Small minus Big) gives the size premium which is the additional return received by investors from investing in companies having a low market capitalization.

HML (High minus Low), gives the value premium which is the return provided to investors for investing in companies having high book-to-market values.

The three factor Fama-French model is written as:

\[\begin{equation} r_{A}-r_{F}=+\beta_{A}(r_{M}-r_{F})+s_{A}SMB+h_{A}HML+\alpha+e \#eq:ff1) \end{equation}\]

Where \(s_{A}\) and \(h_{A}\) capture the security’s sensitivity to these two additional factors.

8.1.1 Data Preprocessing

- The three factors daily data is downloaded as a CSV file from the Kenneth French website. Link: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

- AAPL stock prices are downloaded using the quantmod package

- The following code snippets will pre-process three factor data and stock return data and then combine it in one single

# use read.table for text file

ff_data = read.csv("data/F-F_Research_Data_Factors_daily.CSV", skip = 3)

ff_data = na.omit(ff_data) #remove missing values

head(ff_data) #date is missing column names X Mkt.RF SMB HML RF

1 19260701 0.10 -0.23 -0.28 0.009

2 19260702 0.45 -0.34 -0.03 0.009

3 19260706 0.17 0.29 -0.38 0.009

4 19260707 0.09 -0.59 0.00 0.009

5 19260708 0.21 -0.38 0.18 0.009

6 19260709 -0.71 0.44 0.58 0.009colnames(ff_data)[1] = "Date"

# convert dates in R date format

ff_data$Date = as.Date(strptime(ff_data$Date, format = "%Y%m%d"))

head(ff_data) Date Mkt.RF SMB HML RF

1 1926-07-01 0.10 -0.23 -0.28 0.009

2 1926-07-02 0.45 -0.34 -0.03 0.009

3 1926-07-06 0.17 0.29 -0.38 0.009

4 1926-07-07 0.09 -0.59 0.00 0.009

5 1926-07-08 0.21 -0.38 0.18 0.009

6 1926-07-09 -0.71 0.44 0.58 0.009- Download the data and convert to returns

d_aapl = getSymbols("AAPL", from = "2019-01-01", to = "2021-09-30", auto.assign = F)

# select closing prices and covert to log returns

aapl = d_aapl$AAPL.Close

aapl_ret = dailyReturn(aapl, type = "log")

# convert to data frame

aapl_ret2 = fortify.zoo(aapl_ret) #Dates column will be named Index

# rename

colnames(aapl_ret2) = c("Date", "AAPL")

# use merge (can use left_join from dplyr as well) to combine the

# stock returns and factor data

data_ffex = merge(aapl_ret2, ff_data, by = "Date")8.1.2 Regression Analysis

- The Fama-French regression uses excess returns so first convert Apple returns to excess returns and then fit the model using the

lmfunction

# create another column with AAPL-RF

data_ffex$AAPL.Rf = data_ffex$AAPL - data_ffex$RF

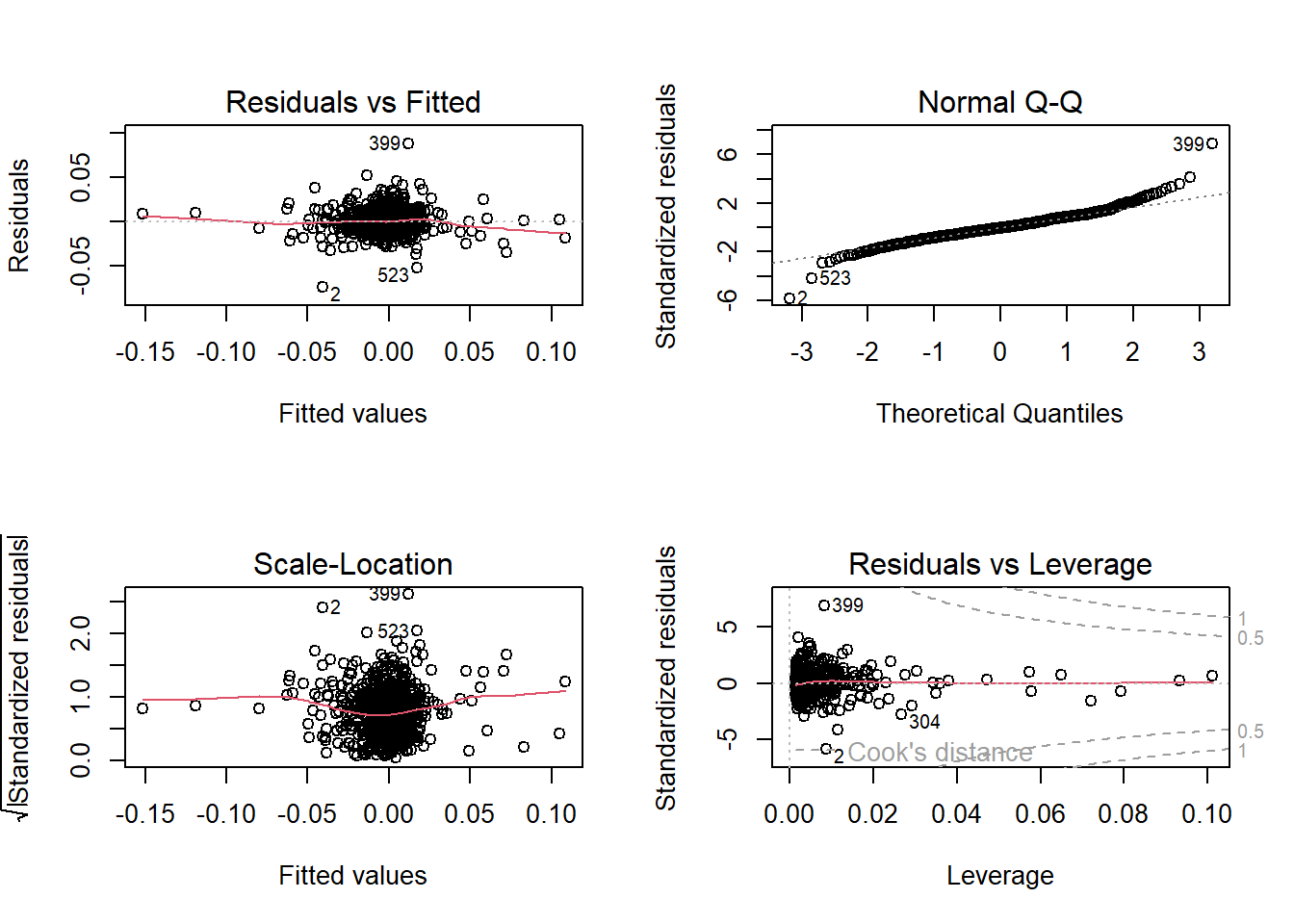

ff_lreg = lm(AAPL.Rf ~ Mkt.RF + SMB + HML, data = data_ffex)- A plot function can be used to plot the four regression plots similar to simple regression.

par(mfrow = c(2, 2))

plot(ff_lreg)

Figure 8.1: Linear Regression Plots

- There are packages in R which provide functions to export the summary output of a regression model in a LaTeX, HTML or ASCII files.

- The output can also be exported to an HTML or LaTeX file which can be later used in a word/LaTeX document.

stargazer(ff_lreg, summary = T, title = "Fama-French Regression OLS", type = "html")| Dependent variable: | |

| AAPL.Rf | |

| Mkt.RF | 0.013*** |

| (0.0003) | |

| SMB | -0.003*** |

| (0.001) | |

| HML | -0.004*** |

| (0.0004) | |

| Constant | -0.003*** |

| (0.0005) | |

| Observations | 692 |

| R2 | 0.677 |

| Adjusted R2 | 0.676 |

| Residual Std. Error | 0.013 (df = 688) |

| F Statistic | 481.374*** (df = 3; 688) |

| Note: | p<0.1; p<0.05; p<0.01 |

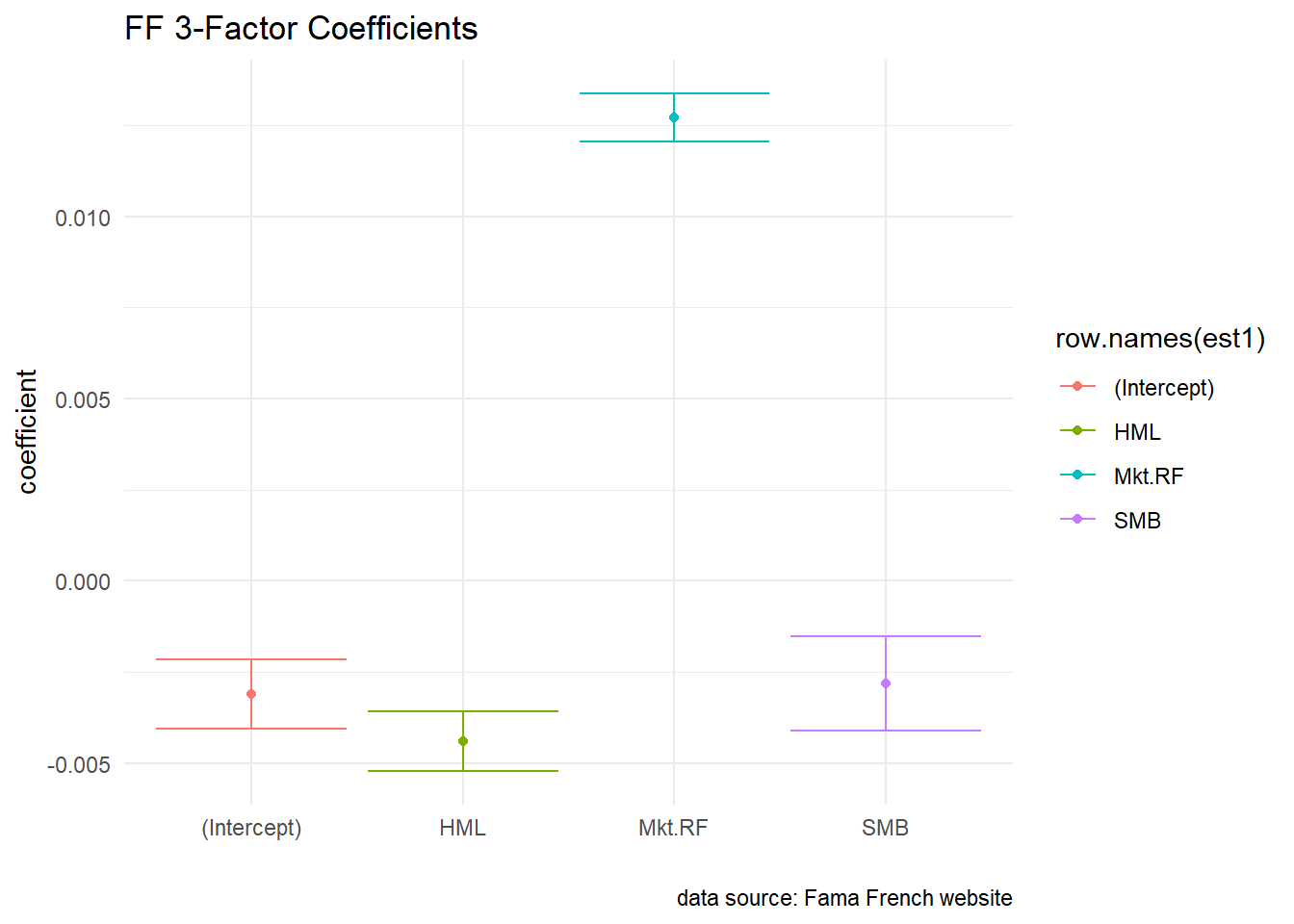

8.1.3 Visualisation

- We can visulise the coefficients with their confidence intervals

s1 = summary(ff_lreg)

c1 = confint(ff_lreg)

est1 = as.data.frame(cbind(s1$coefficients, c1))

p1 = ggplot(est1, aes(x = row.names(est1), y = Estimate, color = row.names(est1))) +

geom_point()

p1 + geom_errorbar(aes(ymin = est1$`2.5 %`, ymax = est1$`97.5 %`)) + labs(title = "FF 3-Factor Coefficients",

x = "", y = "coefficient", caption = "data source: Fama French website") +

theme_minimal()

Figure 8.2: FF Factors with Confidence Interval

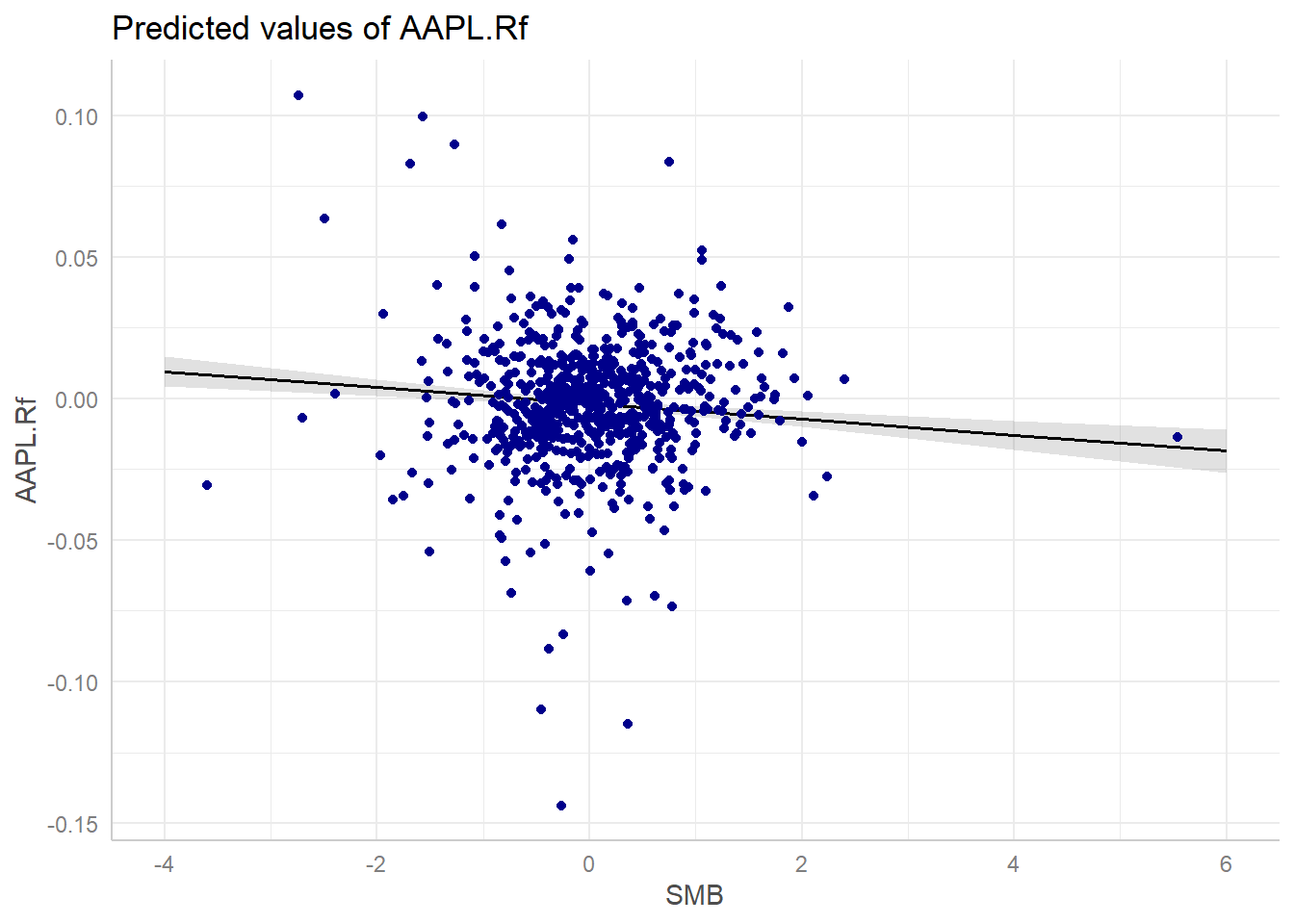

- The ggeffects package provides good functionality on visualising the marginal effects and adjusted predictions. The predictions generated by a model by varying one independent variable and keeping the others constant.

- The following example visualises the predictions based on the SMB factor

library(ggeffects)

mydf = ggpredict(ff_lreg, terms = c("SMB"))

(p_ff = plot(mydf) + geom_point(data = data_ffex, aes(x = SMB, y = AAPL.Rf),

color = "darkblue"))

Figure 8.3: Marginal Effect

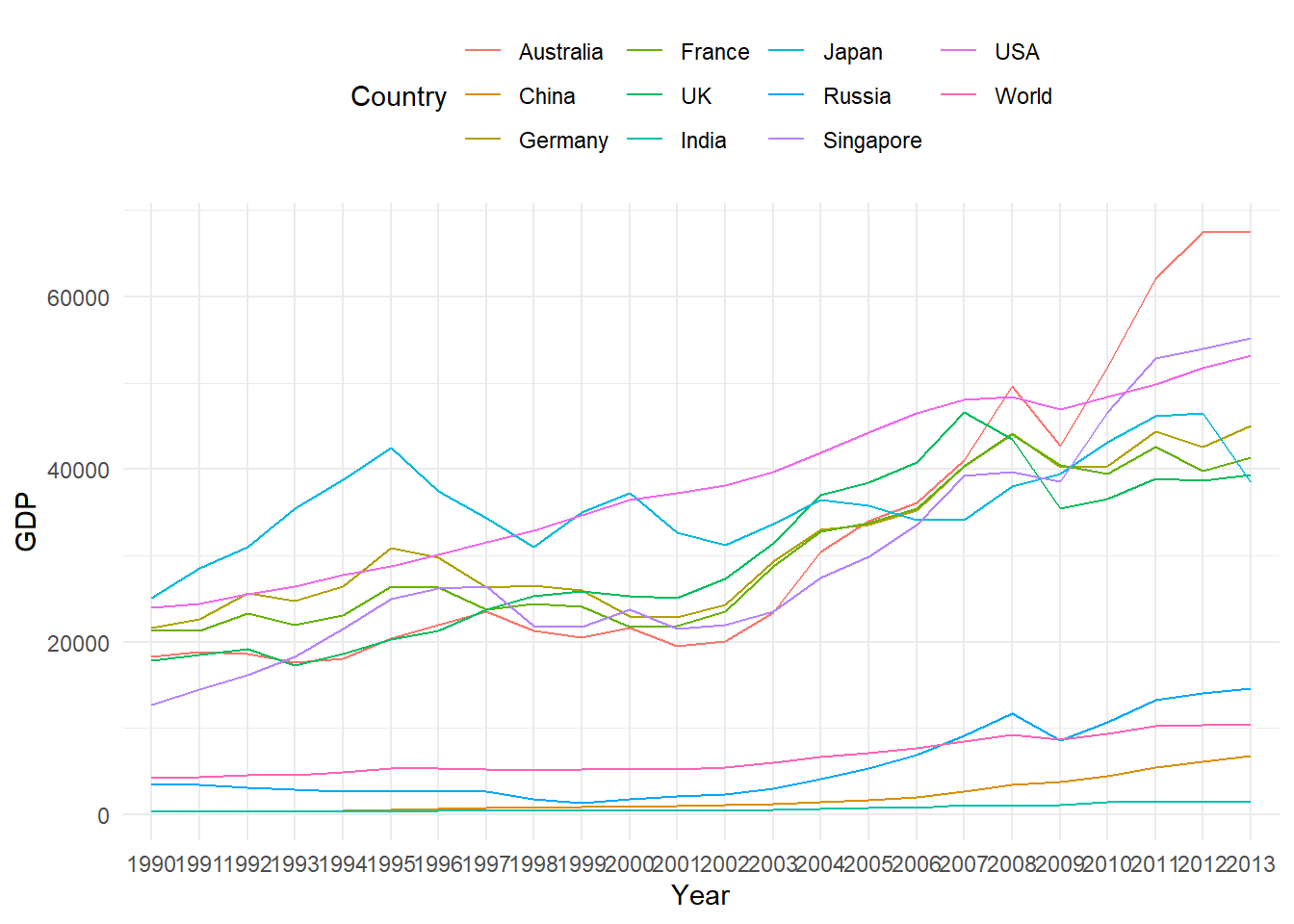

Topic 9 Panel Regression

- Panel data or longitudinal data is a data structure which contains individuals/variables (e.g., persons, firms, countries, cities etc) observed at several points in time (days, months, years, quarters etc).

- The dataset

GDP_l.RDatais an example of panel data where each country’s GDP is recorded over several years in time.

load("data/GDP_l.RData")

# data snapshot

GDP_l[c(1:5, 25:29, 241:245), ] Year Country GDP

1 1990 Australia 18247.3946

2 1991 Australia 18837.1893

3 1992 Australia 18599.0012

4 1993 Australia 17658.0794

5 1994 Australia 18080.6975

25 1990 China 314.4310

26 1991 China 329.7491

27 1992 China 362.8081

28 1993 China 373.8003

29 1994 China 469.2128

241 1990 World 4220.6460

242 1991 World 4357.3096

243 1992 World 4591.0928

244 1993 World 4604.2533

245 1994 World 4882.0794Some visualisation

Line Chart

library(ggplot2)

p1 = ggplot(GDP_l, aes(Year, GDP, group = Country))

p1 + geom_path(aes(color = Country)) + theme_minimal() + theme(legend.position = "top")

Figure 9.1: Panel Data Line Chart

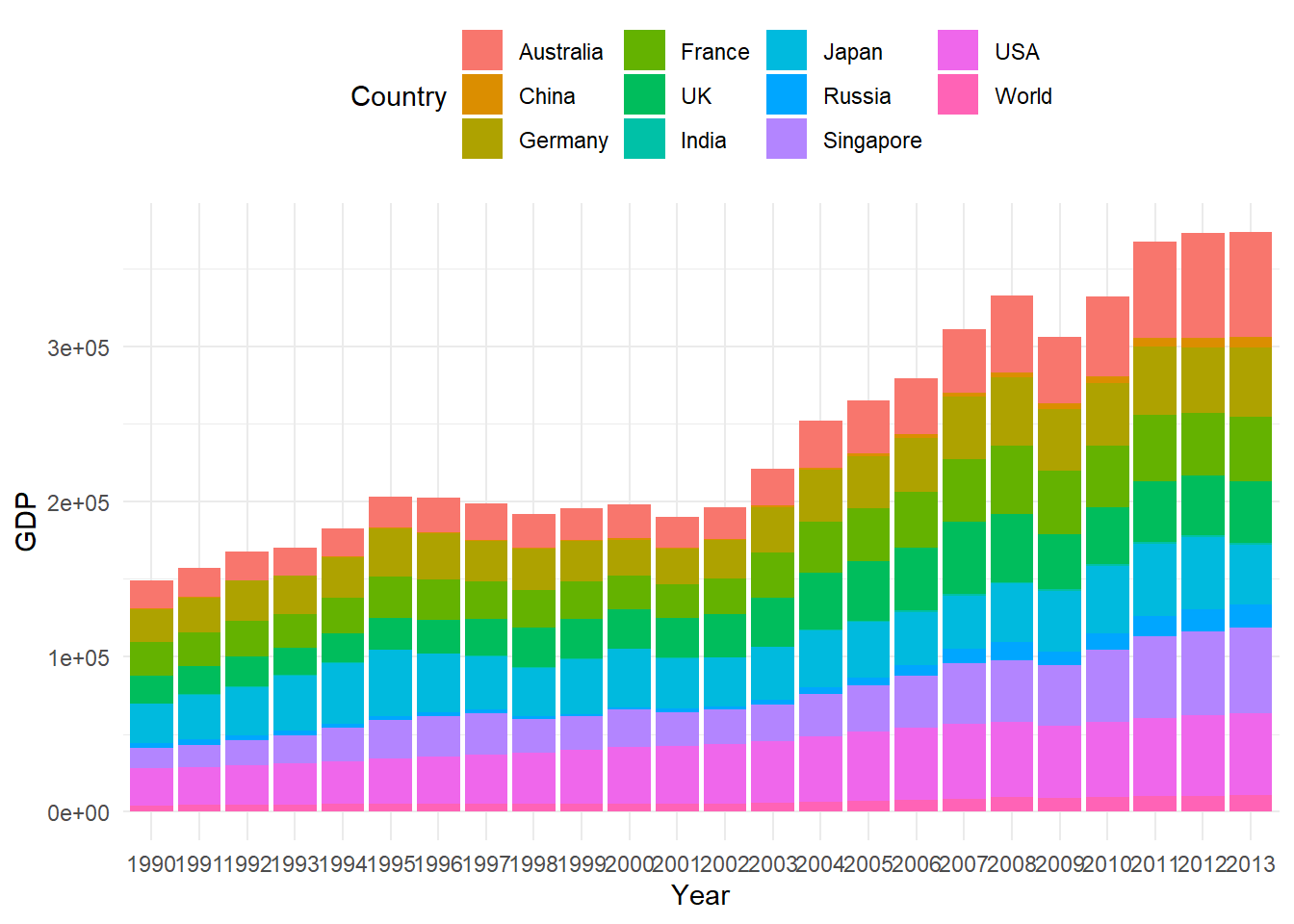

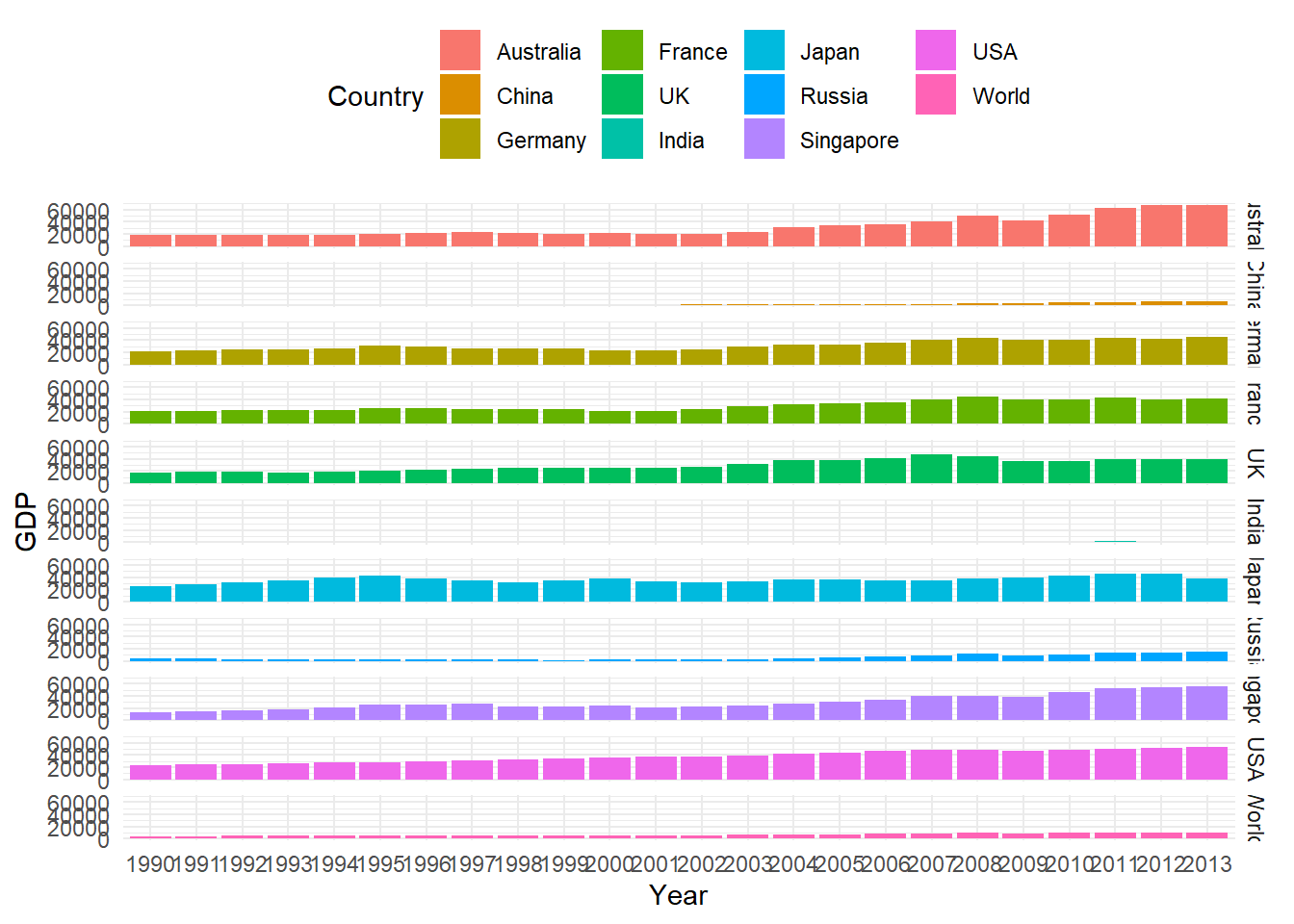

- Bar Chart

p1 + geom_col(aes(fill = Country)) + theme_minimal() + theme(legend.position = "top")

Figure 9.2: Panel Data Bar Chart

- Bar Chart for each country

p1 + geom_col(aes(fill = Country)) + facet_grid(Country ~ .) + theme_minimal() +

theme(legend.position = "top")

Figure 9.3: Panel Data Bar Chart

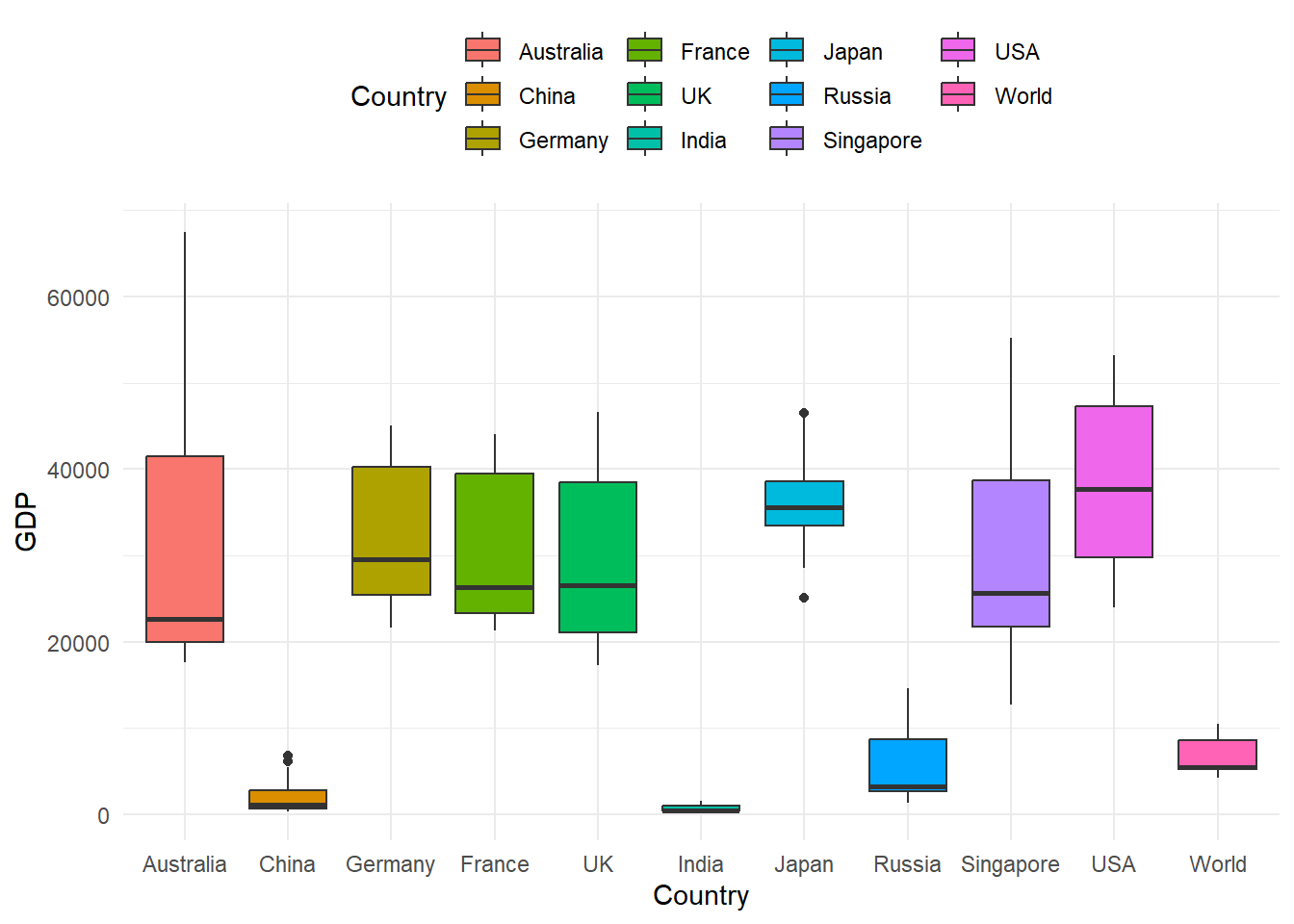

- Box plot

p2 = ggplot(GDP_l, aes(Country, GDP))

p2 + geom_boxplot(aes(fill = Country)) + theme_minimal() + theme(legend.position = "top")

Figure 9.4: Panel Data Box Plot

The GDP data here has a balanced panel structure, where all the variables have values for all points in time.

This chapter discussed the two basic panel regression models viz, Fixed Effect Model and Random Effect Model for balanced panel data.

For an extensive discussion see econometrics textbooks including Baltagi (2005),Wooldridge (2010),Greene (2008) and Stock & Watson (2012).

The package plm Croissant & Millo (2008) provides methods for calculating these models, which will be used for in illustrative code.

We will use the very popular Grunfeld panel dataset Grunfeld (1958) available in the plm package for demostration which are based on similar examples in Croissant & Millo (2008) and Kleiber & Zeileis (2008).

9.1 Fixed and Random effects using the plm package

The argument in is set to for fixed effects model and for a random effects model.

The data can be converted to the required panel format using function, which transforms a regular data frame object into a panel data structure.

is the main argument in the function which specifies the panel structure, i.e, columns with individual and time variables.

# Grunfeld Data representation as per pdata.frame function

library(plm)

data(Grunfeld) #load data

head(Grunfeld) #data snapshot firm year inv value capital

1 1 1935 317.6 3078.5 2.8

2 1 1936 391.8 4661.7 52.6

3 1 1937 410.6 5387.1 156.9

4 1 1938 257.7 2792.2 209.2

5 1 1939 330.8 4313.2 203.4

6 1 1940 461.2 4643.9 207.2pdata1 = pdata.frame(Grunfeld, index = c("firm", "year"))

head(pdata1) firm year inv value capital

1-1935 1 1935 317.6 3078.5 2.8

1-1936 1 1936 391.8 4661.7 52.6

1-1937 1 1937 410.6 5387.1 156.9

1-1938 1 1938 257.7 2792.2 209.2

1-1939 1 1939 330.8 4313.2 203.4

1-1940 1 1940 461.2 4643.9 207.29.2 Fixed Effects Model

- We can use the plm package to replicate the following investment equation as considered by Grunfeld (Grunfeld, 1958).

\[\begin{equation} I_{it}=\alpha+\beta_{1}F_{it}+\beta_{2}C_{it}+\varepsilon_{it} \tag{9.1} \end{equation}\]

The model in equation-1 is a one-way panel regression model which attempts to quantify the dependence of real gross investment (\(I_{it}\)) on the real value of the company (\(F_{it}\)) and real value of its capital stock (\(C_{it}\)).

- Grunfeld (1958) studied 10 large manufacturing firms from the United States over 20 years (1935-954). A fixed effect estimation can be obtained with the following code

# using plm with 'within' estimator for fixed effects

fe1 = plm(inv ~ value + capital, data = pdata1, model = "within")

# the output can be summarised with summary

summary(fe1)Oneway (individual) effect Within Model

Call:

plm(formula = inv ~ value + capital, data = pdata1, model = "within")

Balanced Panel: n = 10, T = 20, N = 200

Residuals:

Min. 1st Qu. Median 3rd Qu. Max.

-184.00857 -17.64316 0.56337 19.19222 250.70974

Coefficients:

Estimate Std. Error t-value Pr(>|t|)

value 0.110124 0.011857 9.2879 < 2.2e-16 ***

capital 0.310065 0.017355 17.8666 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Total Sum of Squares: 2244400

Residual Sum of Squares: 523480

R-Squared: 0.76676

Adj. R-Squared: 0.75311

F-statistic: 309.014 on 2 and 188 DF, p-value: < 2.22e-16The summary output for the fitted model object gives details about the fitted object.

The individual fixed effects can be obtained using the function , a summary method is also available as shown next

# individual fixed effects

fixef(fe1) 1 2 3 4 5 6 7 8

-70.2967 101.9058 -235.5718 -27.8093 -114.6168 -23.1613 -66.5535 -57.5457

9 10

-87.2223 -6.5678 # summary

summary(fixef(fe1)) Estimate Std. Error t-value Pr(>|t|)

1 -70.2967 49.7080 -1.4142 0.15896

2 101.9058 24.9383 4.0863 6.485e-05 ***

3 -235.5718 24.4316 -9.6421 < 2.2e-16 ***

4 -27.8093 14.0778 -1.9754 0.04969 *

5 -114.6168 14.1654 -8.0913 7.141e-14 ***

6 -23.1613 12.6687 -1.8282 0.06910 .

7 -66.5535 12.8430 -5.1821 5.629e-07 ***

8 -57.5457 13.9931 -4.1124 5.848e-05 ***

9 -87.2223 12.8919 -6.7657 1.635e-10 ***

10 -6.5678 11.8269 -0.5553 0.57933

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 19.3 Random Effects Model

A random effect model can be estimated by setting the argument to .

There are five different methods available for estimation of the variance component (Baltagi (2005)) which can be selected using the argument.

• The following output is obtained using the default Swamy-Arora (Swamy & Arora (1972)) random method.

# random effect model

re1 = plm(inv ~ value + capital, data = pdata1, model = "random")

# summary

summary(re1)Oneway (individual) effect Random Effect Model

(Swamy-Arora's transformation)

Call:

plm(formula = inv ~ value + capital, data = pdata1, model = "random")

Balanced Panel: n = 10, T = 20, N = 200

Effects:

var std.dev share

idiosyncratic 2784.46 52.77 0.282

individual 7089.80 84.20 0.718

theta: 0.8612

Residuals:

Min. 1st Qu. Median 3rd Qu. Max.

-177.6063 -19.7350 4.6851 19.5105 252.8743

Coefficients:

Estimate Std. Error z-value Pr(>|z|)

(Intercept) -57.834415 28.898935 -2.0013 0.04536 *

value 0.109781 0.010493 10.4627 < 2e-16 ***

capital 0.308113 0.017180 17.9339 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Total Sum of Squares: 2381400

Residual Sum of Squares: 548900

R-Squared: 0.7695

Adj. R-Squared: 0.76716

Chisq: 657.674 on 2 DF, p-value: < 2.22e-169.4 Testing

9.4.1 Panel or OLS

It is important to test if the panel regression model is signficantly different from the OLS model. In other words, do we need a panel model or OLS model is good enough?

The function in the plm package can be used to test a fitted fixed effect model against a fitted OLS model to check which regression is a better choice.

# Simple OLS (without the intercept) using pooling

ols1 = plm(inv ~ value + capital - 1, data = pdata1, model = "pooling")

# summary of results

summary(ols1)Pooling Model

Call:

plm(formula = inv ~ value + capital - 1, data = pdata1, model = "pooling")

Balanced Panel: n = 10, T = 20, N = 200

Residuals:

Min. 1st Qu. Median Mean 3rd Qu. Max.

-270.32 -51.32 -23.69 -21.04 -4.51 476.74

Coefficients:

Estimate Std. Error t-value Pr(>|t|)

value 0.1076384 0.0058256 18.4769 < 2.2e-16 ***

capital 0.1832062 0.0242750 7.5471 1.587e-12 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Total Sum of Squares: 9359900

Residual Sum of Squares: 1935600

R-Squared: 0.8113

Adj. R-Squared: 0.81035

F-statistic: 597.659 on 2 and 198 DF, p-value: < 2.22e-16- The above OLS model can now be tested against the fixed effect model to check for the best fit.

# Testing for the better model, null: OLS is a better

pFtest(fe1, ols1)

F test for individual effects

data: inv ~ value + capital

F = 50.714, df1 = 10, df2 = 188, p-value < 2.2e-16

alternative hypothesis: significant effects- Similar to the fixed effect and OLS comparison one can also check if the random effects are needed using one of the available Langrange multiplier tests (Breusch & Pagan (1980) test here) test in function as illustrated below

# plmtest using the Breuch-Pagan method

plmtest(ols1, type = c("bp"))

Lagrange Multiplier Test - (Breusch-Pagan)

data: inv ~ value + capital - 1

chisq = 727.84, df = 1, p-value < 2.2e-16

alternative hypothesis: significant effects- A p-value<0.05 in the above test indicates that the Random Effect model is required.

9.4.2 Fixed Effect or Random Effect

- The Hausman test (Hausman (1978)) is the standard approach to test for model specification which can be computed using the function in the plm package.

# phtest using the fitted models in fe1 and re1

phtest(fe1, re1)

Hausman Test

data: inv ~ value + capital

chisq = 2.3304, df = 2, p-value = 0.3119

alternative hypothesis: one model is inconsistent- A p-value<0.05 suggests that the fixed effect model is appropriate so in this case the random effect model should be used.