Topic 16 Financial Fraud Analytics

16.1 Introduction to Financial Fraud

Financial institutions deliver several kinds of critical services usually managing high-volume transactions.

Each of these services is afflicted by specific frauds aiming at making illegal profits by unauthorized access to someone’s funds

Earnings manipulation and accounting fraud leads to reduced firm valuation in the long run and a public distrust in the company and its management.

The phenomena of earnings manipulation is not new globally. In 2001, Enron filed for bankruptcy after an accounting fraud resulted in $ 74 billion loss to the shareholders

Firms can manipulate earnings by utilizing their accounting choices known as accrual manipulations.

16.1.1 Types of Financial Fraud

There are various types of financial fraud. The following lists types of financial frauds as listed in Al-Hashedi & Magalingam (2021)

- Credit Card Fraud

- Mortgage Fraud

- Money Laundering

- Financial statement fraud

- Securities and commodities fraud

- Insurance Fraud

- Cryptocurrency Fraud

- Cyber Financial Fraud

16.1.2 ML and AI for Fraud Detection

There are various statistics and ML based classification techniques which are used for detecting fraud. Some of these techniques are

- Support Vector Machines

- Naive Bayes

- Neural Network and Deep Learning

- Random Forests

- Logistic Regression

- KNN

- Decision Trees

- Genetic Algorithms

- Clustering

Ali et al. (2022), Bin Sulaiman, Schetinin, & Sant (2022), Ashtiani & Raahemi (2021), Al-Hashedi & Magalingam (2021), Sadgali, Sael, & Benabbou (2019) provide a review of ML and AI techniques used for financial fraud detection. Bin Sulaiman et al. (2022) provides a review of ML approaches used for Credit Card Fraud Detection.

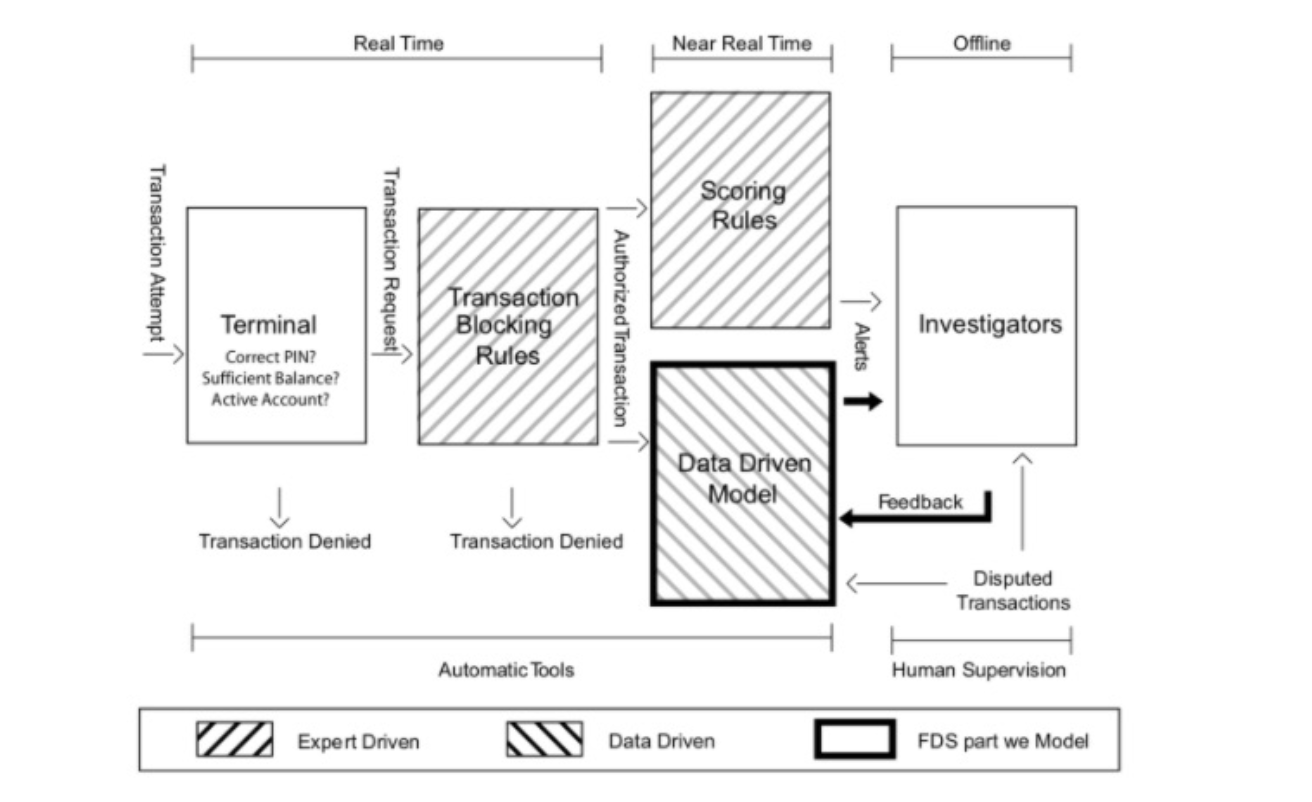

16.1.3 ML and AI based Fraud Detection System for Credit Card Fraud

Fig-16.1 providesan example of a credit card fraud detection system (source: Le Borgne, Siblini, Lebichot, & Bontempi (2022) Link)

Figure 5.1: Fraud Detection System (Le Borgne et al. (2022))

Next we will discuss a brief example on using ML for Fraud Detection using Labelled data

16.2 Detecting Fraud in Transaction Data

16.2.1 Data

The data is a sample from the simulated transaction dataset availabe on Kaggle.

The kaggle datasets link provides a description of the dataset.

The kaggle dataset is highly unbalanced and requires subsampling techniques like SMOTE.

Chapter-11 of the caret package manual provides a good introduction to subsampling for class imbalances.

The data sample here consists of 10000 observations of 80:20, fraud and no fraud classifications.

Overview of the data

data1 = readRDS("data/fraud_sim.rds")

head(data1) step type amount nameOrig oldbalanceOrg newbalanceOrig

3193213 247 CASH_OUT 802421.4 C369107118 802421.4 0

6001559 427 TRANSFER 225324.0 C1109518048 225324.0 0

6009616 441 TRANSFER 107363.5 C564631760 107363.5 0

6020272 461 CASH_OUT 1028284.8 C2004363483 1028284.8 0

6034233 476 CASH_OUT 1146381.4 C169415375 1146381.4 0

1030588 74 TRANSFER 4582074.5 C1151172465 4582074.5 0

nameDest oldbalanceDest newbalanceDest isFraud isFlaggedFraud

3193213 C463164064 11846261.7 12648683 1 0

6001559 C1691016675 0.0 0 1 0

6009616 C43570912 0.0 0 1 0

6020272 C165602524 0.0 1028285 1 0

6034233 C1774696541 484779.2 1631161 1 0

1030588 C2088124795 0.0 0 1 0- Data description

- The data consists of 11 attributes

- step: Unit of time, 1 step is 1 hour

- Type: CASH-IN, CASH-OUT, DEBIT, PAYMENT and TRANSFER

- amount: amount of the transaction in local currency

- nameOrg: customer starting the transaction

- oldbalanceorg: initial balance before the transaction

- newlabalanceorig: balance after the transaction

- nameDest: recepient ID of the transaction

- oldBalanceDest: initial recepient balance before the transaction

- newBalanceDest: recepients balance after the transaction

- isFraud: is fradualant (1), not fradualant (0)

- isFlaggedFraud: flags illegal attemps to transfer more that 200,000 units at a time

16.2.2 Summary of the data

library(dplyr)

library(psych)

library(pastecs)

library(tidyr)

library(pander)

pander(stat.desc(data1))| step | type | amount | nameOrig | oldbalanceOrg | |

|---|---|---|---|---|---|

| nbr.val | 10000 | NA | 10000 | NA | 10000 |

| nbr.null | 0 | NA | 3 | NA | 2683 |

| nbr.na | 0 | NA | 0 | NA | 0 |

| min | 1 | NA | 0 | NA | 0 |

| max | 743 | NA | 22925830 | NA | 59585040 |

| range | 742 | NA | 22925830 | NA | 59585040 |

| sum | 2671835 | NA | 4.433e+09 | NA | 9.918e+09 |

| median | 255.5 | NA | 108649 | NA | 31011 |

| mean | 267.2 | NA | 443257 | NA | 991799 |

| SE.mean | 1.67 | NA | 13125 | NA | 30621 |

| CI.mean.0.95 | 3.273 | NA | 25728 | NA | 60022 |

| var | 27878 | NA | 1.723e+12 | NA | 9.376e+12 |

| std.dev | 167 | NA | 1312501 | NA | 3062058 |

| coef.var | 0.6249 | NA | 2.961 | NA | 3.087 |

| newbalanceOrig | nameDest | oldbalanceDest | newbalanceDest | |

|---|---|---|---|---|

| nbr.val | 10000 | NA | 10000 | 10000 |

| nbr.null | 6619 | NA | 4709 | 4038 |

| nbr.na | 0 | NA | 0 | 0 |

| min | 0 | NA | 0 | 0 |

| max | 49585040 | NA | 93819985 | 94779646 |

| range | 49585040 | NA | 93819985 | 94779646 |

| sum | 7.137e+09 | NA | 9.446e+09 | 1.202e+10 |

| median | 0 | NA | 42762 | 195569 |

| mean | 713720 | NA | 944604 | 1202204 |

| SE.mean | 27920 | NA | 28396 | 32128 |

| CI.mean.0.95 | 54729 | NA | 55661 | 62978 |

| var | 7.795e+12 | NA | 8.063e+12 | 1.032e+13 |

| std.dev | 2791998 | NA | 2839565 | 3212822 |

| coef.var | 3.912 | NA | 3.006 | 2.672 |

| isFraud | isFlaggedFraud | |

|---|---|---|

| nbr.val | 10000 | 10000 |

| nbr.null | 8000 | 9996 |

| nbr.na | 0 | 0 |

| min | 0 | 0 |

| max | 1 | 1 |

| range | 1 | 1 |

| sum | 2000 | 4 |

| median | 0 | 0 |

| mean | 0.2 | 4e-04 |

| SE.mean | 0.004 | 2e-04 |

| CI.mean.0.95 | 0.007841 | 0.000392 |

| var | 0.16 | 0.0003999 |

| std.dev | 0.4 | 0.02 |

| coef.var | 2 | 49.99 |

# summarise(data1) %>% select(name,type,na, mean, median, min, max, nlevs)

# summary(data1)- Number of frauds/nofrauds

prop.table(table(data1$isFraud))

0 1

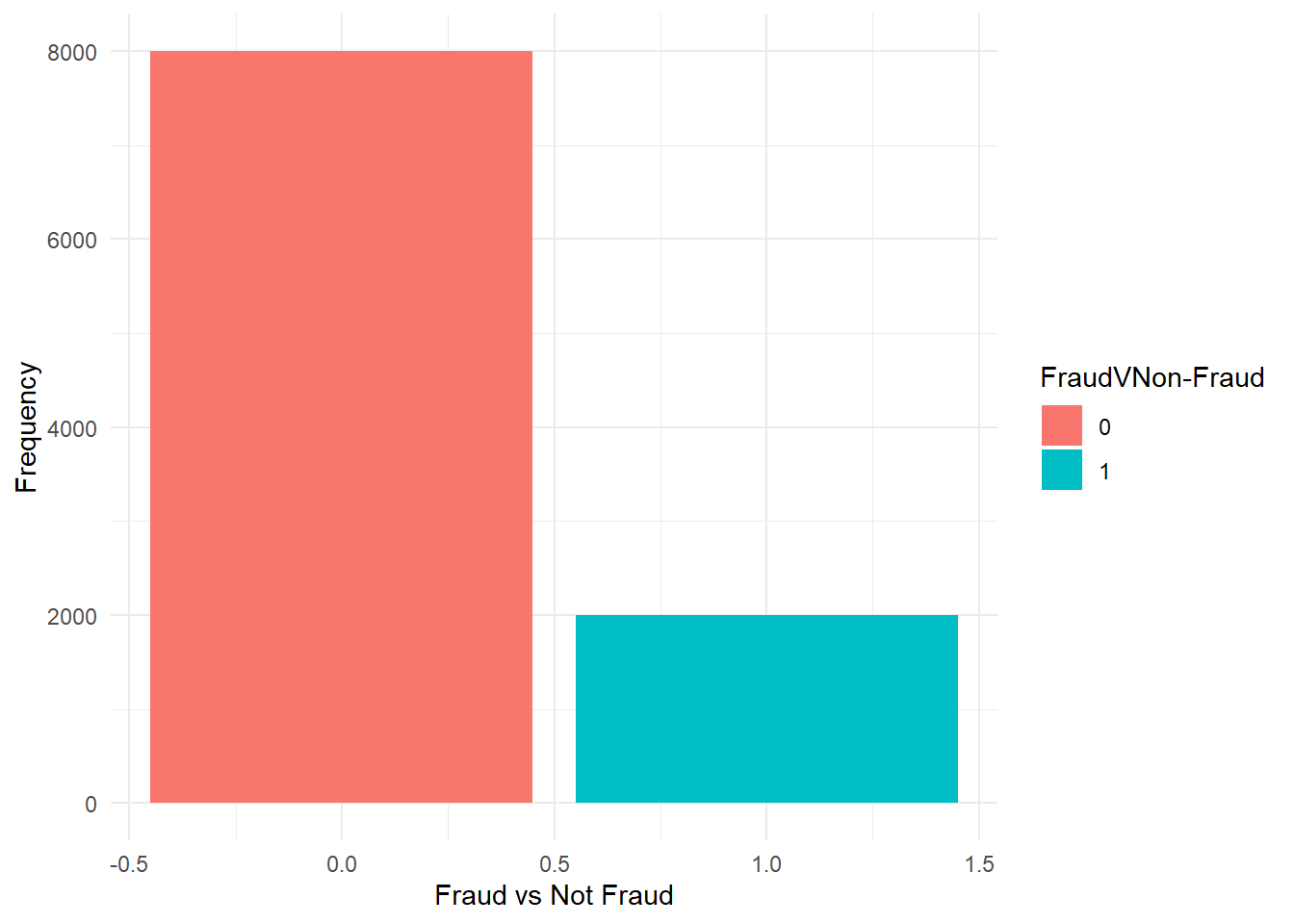

0.8 0.2 16.2.3 Visualisation

library(ggplot2)

theme_set(theme_minimal()) #globally sets the theme

data1 %>%

ggplot(aes(isFraud, fill = factor(isFraud))) + geom_bar(stat = "count") + labs(x = "Fraud vs Not Fraud",

y = "Frequency", fill = "FraudVNon-Fraud")

Figure 16.1: FraudVNon-Fraud

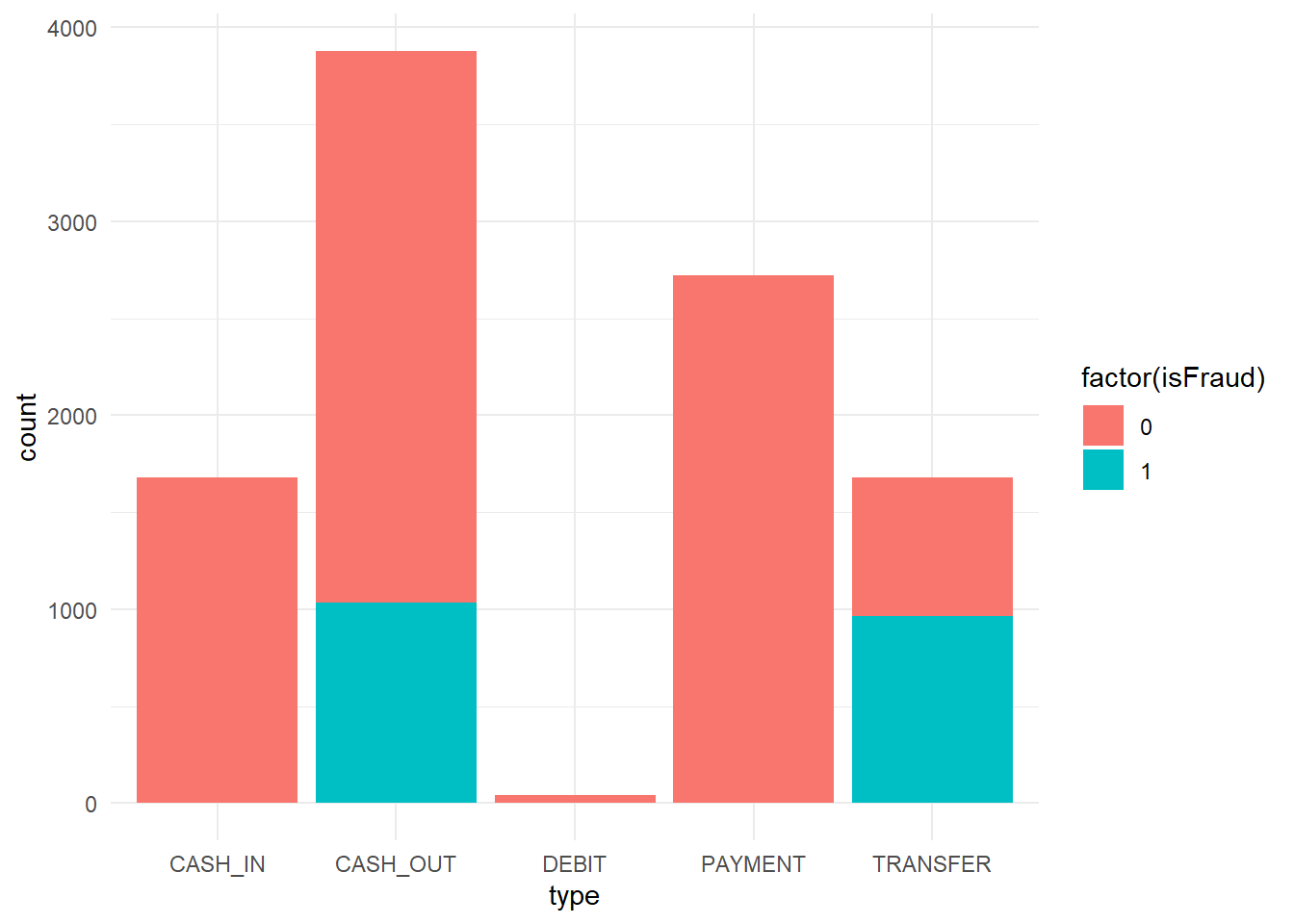

- Transactions based on Fraud

data1 %>%

ggplot(aes(x = type, fill = factor(isFraud))) + geom_bar()

Figure 16.2: Transaction by Fraud

The figure shows that most frauds in the data sample are committed in CASH_OUT of in TRANSFER transaction type

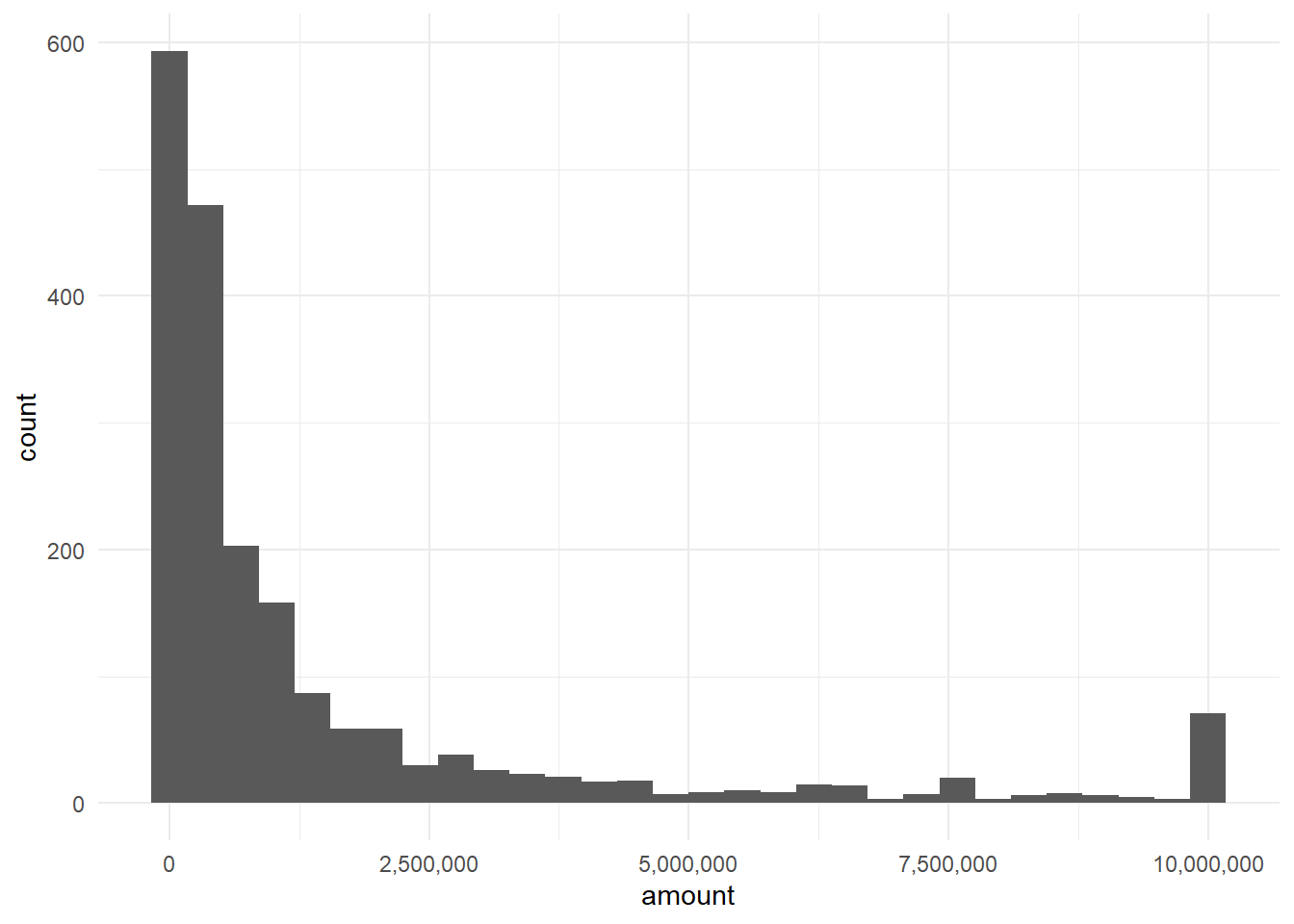

- Distribution of Transactions

library(dplyr)

library(scales)

data1 %>%

filter(isFraud == 1) %>%

ggplot(aes(amount)) + geom_histogram() + scale_x_continuous(labels = comma)

Figure 16.3: Fradualent Amount

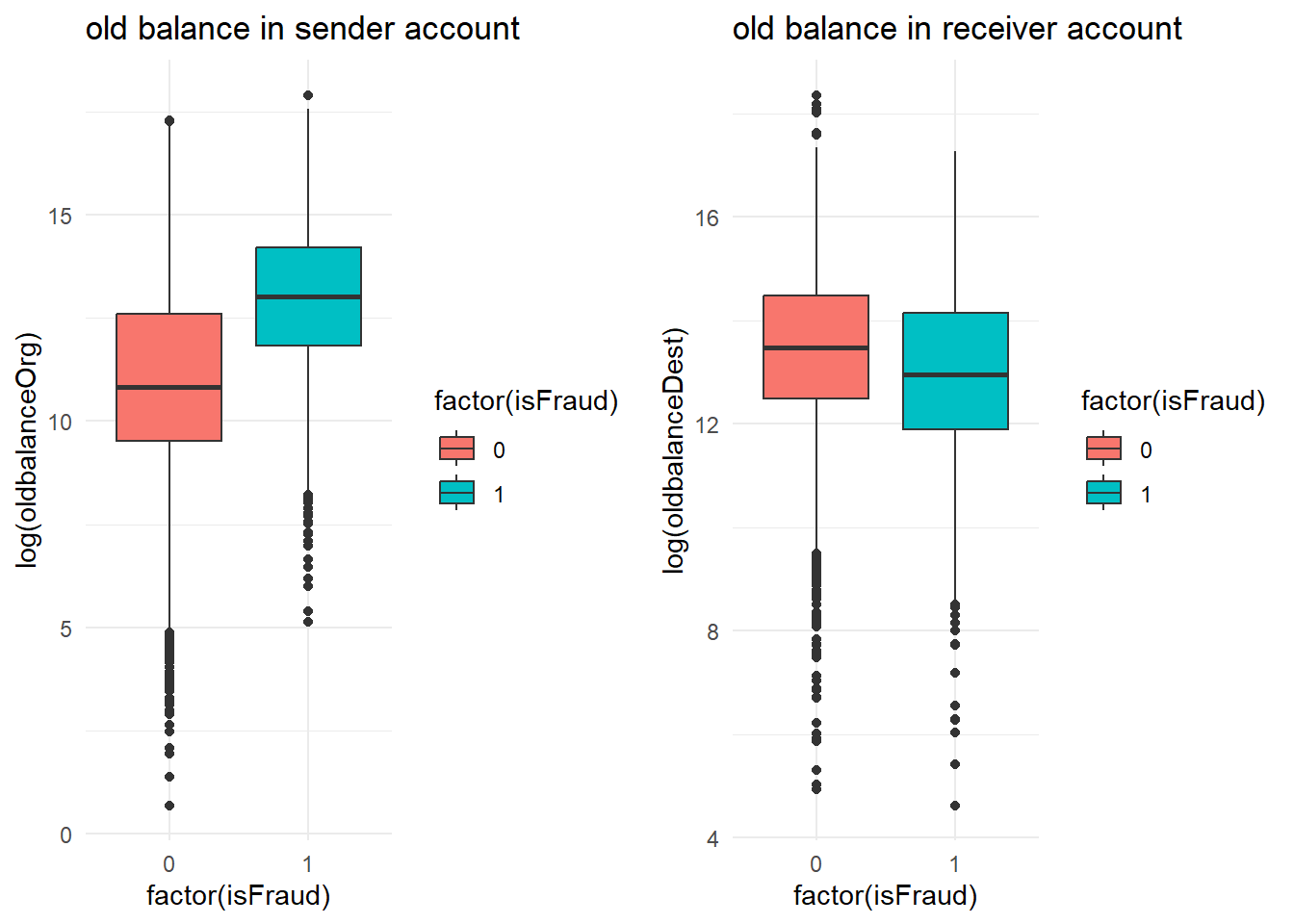

- What about balance in accounts?

p1 = data1 %>%

ggplot(aes(x = factor(isFraud), y = log(oldbalanceOrg), fill = factor(isFraud))) +

geom_boxplot() + labs(title = "old balance in sender account")

p2 = data1 %>%

ggplot(aes(x = factor(isFraud), y = log(oldbalanceDest), fill = factor(isFraud))) +

geom_boxplot() + labs(title = "old balance in receiver account")

library(gridExtra)

grid.arrange(p1, p2, nrow = 1)

Figure 16.4: Balance (sender/receiver)

Task: Create other visualisations to visually analyse the data

16.3 ML Model

- There are various ML models possible but we will use KNN, Random Forests and Neural Networks

16.3.1 Setup

Select the most useful columns

library(fastDummies) #for creating dummy columns

data2 = data1 %>%

select(-c("step", "nameOrig", "nameDest", "isFlaggedFraud")) %>%

filter(type %in% c("CASH_OUT", "TRANSFER"))

data3 = dummy_cols(data2) #takes the column with factors and creates dummies based on that

data3$isFraud = as.factor(data3$isFraud)

data3 = data3[, -1]16.3.2 Sampling and Resampling

- As this is a sample which does not depend on the time series structure, we can use random sampling stratified by the default

library(rsample)

set.seed(123)

idx = initial_split(data3, prop = 0.7, strata = "isFraud")

d_train1 = training(idx)

d_test1 = testing(idx)- Resampling

library(caret)

cntrl1 = trainControl(method = "repeatedcv", number = 10, repeats = 2, allowParallel = TRUE)

prep1 = c("center", "scale", "zv")16.3.3 KNN

set.seed(123)

mod1_fraud_knn = train(isFraud ~ ., data = d_train1, method = "knn", tuneLength = 10,

preProcess = prep1, trControl = cntrl1)- Model

mod1_fraud_knnk-Nearest Neighbors

3889 samples

7 predictor

2 classes: '0', '1'

Pre-processing: centered (7), scaled (7)

Resampling: Cross-Validated (10 fold, repeated 2 times)

Summary of sample sizes: 3500, 3500, 3500, 3500, 3500, 3500, ...

Resampling results across tuning parameters:

k Accuracy Kappa

5 0.9497300 0.8905007

7 0.9483165 0.8873509

9 0.9466455 0.8834357

11 0.9458736 0.8816692

13 0.9429167 0.8750019

15 0.9411165 0.8707704

17 0.9381596 0.8640186

19 0.9368746 0.8611598

21 0.9343039 0.8554145

23 0.9328887 0.8522490

Accuracy was used to select the optimal model using the largest value.

The final value used for the model was k = 5.- Predictive Accuracy

set.seed(123)

pred1 = predict(mod1_fraud_knn, newdata = d_test1)

confusionMatrix(pred1, d_test1$isFraud)Confusion Matrix and Statistics

Reference

Prediction 0 1

0 1026 50

1 41 550

Accuracy : 0.9454

95% CI : (0.9334, 0.9558)

No Information Rate : 0.6401

P-Value [Acc > NIR] : <2e-16

Kappa : 0.8811

Mcnemar's Test P-Value : 0.4017

Sensitivity : 0.9616

Specificity : 0.9167

Pos Pred Value : 0.9535

Neg Pred Value : 0.9306

Prevalence : 0.6401

Detection Rate : 0.6155

Detection Prevalence : 0.6455

Balanced Accuracy : 0.9391

'Positive' Class : 0

16.3.4 Random Forests

mtry = sqrt(ncol(d_test1))

tunegrid = expand.grid(.mtry = mtry)

library(doParallel)

cl = makePSOCKcluster(detectCores()/2)

registerDoParallel(cl)

set.seed(123)

rf_fraud = train(isFraud ~ ., data = d_train1, method = "rf", tuneGrid = tunegrid,

trControl = cntrl1, preProcess = prep1)

stopCluster(cl)

registerDoSEQ()- Model

rf_fraudRandom Forest

3889 samples

7 predictor

2 classes: '0', '1'

Pre-processing: centered (7), scaled (7)

Resampling: Cross-Validated (10 fold, repeated 2 times)

Summary of sample sizes: 3500, 3500, 3500, 3500, 3500, 3500, ...

Resampling results:

Accuracy Kappa

0.9755708 0.9469659

Tuning parameter 'mtry' was held constant at a value of 2.828427- Predictive Accuracy

set.seed(123)

pred2 = predict(rf_fraud, newdata = d_test1)

confusionMatrix(pred2, d_test1$isFraud)Confusion Matrix and Statistics

Reference

Prediction 0 1

0 1049 15

1 18 585

Accuracy : 0.9802

95% CI : (0.9723, 0.9863)

No Information Rate : 0.6401

P-Value [Acc > NIR] : <2e-16

Kappa : 0.9571

Mcnemar's Test P-Value : 0.7277

Sensitivity : 0.9831

Specificity : 0.9750

Pos Pred Value : 0.9859

Neg Pred Value : 0.9701

Prevalence : 0.6401

Detection Rate : 0.6293

Detection Prevalence : 0.6383

Balanced Accuracy : 0.9791

'Positive' Class : 0

16.3.5 NNET

library(doParallel)

cl = makePSOCKcluster(detectCores()/2)

registerDoParallel(cl)

set.seed(123)

nnet_fraud = train(isFraud ~ ., data = d_train1, method = "nnet", trControl = cntrl1,

preProcess = prep1)# weights: 28

initial value 2899.085170

iter 10 value 1454.628563

iter 20 value 537.562073

iter 30 value 332.100069

iter 40 value 189.749918

iter 50 value 152.552874

iter 60 value 112.587854

iter 70 value 106.284558

iter 80 value 98.840062

iter 90 value 95.032644

iter 100 value 93.058743

final value 93.058743

stopped after 100 iterationsstopCluster(cl)

registerDoSEQ()- Model

nnet_fraudNeural Network

3889 samples

7 predictor

2 classes: '0', '1'

Pre-processing: centered (7), scaled (7)

Resampling: Cross-Validated (10 fold, repeated 2 times)

Summary of sample sizes: 3500, 3500, 3500, 3500, 3500, 3500, ...

Resampling results across tuning parameters:

size decay Accuracy Kappa

1 0e+00 0.9805866 0.9575230

1 1e-04 0.9820012 0.9610373

1 1e-01 0.9553895 0.9021244

3 0e+00 0.9845725 0.9665263

3 1e-04 0.9822559 0.9615537

3 1e-01 0.9628459 0.9186841

5 0e+00 0.9832875 0.9636761

5 1e-04 0.9823854 0.9618194

5 1e-01 0.9633603 0.9197440

Accuracy was used to select the optimal model using the largest value.

The final values used for the model were size = 3 and decay = 0.- Predictive Accuracy

set.seed(123)

pred3 = predict(nnet_fraud, newdata = d_test1)

confusionMatrix(pred3, d_test1$isFraud)Confusion Matrix and Statistics

Reference

Prediction 0 1

0 1060 9

1 7 591

Accuracy : 0.9904

95% CI : (0.9845, 0.9945)

No Information Rate : 0.6401

P-Value [Acc > NIR] : <2e-16

Kappa : 0.9792

Mcnemar's Test P-Value : 0.8026

Sensitivity : 0.9934

Specificity : 0.9850

Pos Pred Value : 0.9916

Neg Pred Value : 0.9883

Prevalence : 0.6401

Detection Rate : 0.6359

Detection Prevalence : 0.6413

Balanced Accuracy : 0.9892

'Positive' Class : 0