Topic 15 Decision Trees using R

Some references: Boehmke & Greenwell (2019), Hastie et al. (2013) and Lantz (2019)

In this section we discuss tree based methods for classification.

Tree-based models are a class of non-parametric algorithms that work by partitioning the feature space into a number of smaller (non-overlapping) regions with similar response values using a set of splitting rules.

These involve stratifying or segmenting the predictor space into a number of simple regions.

Typically use the mean or the mode of the training observations in the region to which it belongs.

Since the set of splitting rules used to segment the predictor space can be summarized in a tree, these types of approaches are known as decision tree methods.

Classification and Regression Tree (CART) (Breiman, Friedman, Stone, & Olshen (1984)) is the most well-known decision tree algorithm.

- CART uses binary recursive partitioning: Each split depends on the split above (before) it.

A basic decision tree partitions the training data into homogeneous subgroups (i.e., groups with similar response values) and then fits a simple constant in each subgroup (e.g., the mean of the within group response values for regression).

The subgroups (also called nodes) are formed recursively using binary partitions formed by asking simple yes-or-no questions about each feature.

This is done a number of times until a suitable stopping criteria is satisfied (e.g., a maximum depth of the tree is reached).

After all the partitioning has been done, the model predicts the output based on

- the average response values for all observations that fall in that subgroup (regression problem), or

- the class that has majority representation (classification problem)

Root node: First subgroup

Terminal node or Leaf node: Final subgroup

Internal node: Other subgroups between root and terminal node

Branches: Connection between the nodes

We will apply the CART method on a Credit Risk Example

Two types of risks are associated with the bank’s decision

- If the applicant is a good credit risk, i.e. is likely to repay the loan, then not approving the loan to the person results in a loss of business to the bank

- If the applicant is a bad credit risk, i.e. is not likely to repay the loan, then approving the loan to the person results in a financial loss to the bank

This analysis is an example and is not exhaustive list of methods available for data description, visualisation or ML using R.

15.1 Import Data and Pre-processing

Data discription is here https://onlinecourses.science.psu.edu/stat508/book/export/html/796

20 variables

Status of existing checking account. Duration in month Credit history Purpose Credit amount Savings account/bonds Present employment since Installment rate in percentage of disposable income Personal status and sex Other debtors / guarantors Present residence since Property Age in years Other installment plans Housing Number of existing credits at this bank Job Number of people being liable to provide maintenance for Telephone foreign worker

data_cr = read.csv("data/german_credit.csv")

# preliminary analysis descriptive and visual

str(data_cr)'data.frame': 1000 obs. of 21 variables:

$ Creditability : int 1 1 1 1 1 1 1 1 1 1 ...

$ Account.Balance : int 1 1 2 1 1 1 1 1 4 2 ...

$ Duration.of.Credit..month. : int 18 9 12 12 12 10 8 6 18 24 ...

$ Payment.Status.of.Previous.Credit: int 4 4 2 4 4 4 4 4 4 2 ...

$ Purpose : int 2 0 9 0 0 0 0 0 3 3 ...

$ Credit.Amount : int 1049 2799 841 2122 2171 2241 3398 1361 1098 3758 ...

$ Value.Savings.Stocks : int 1 1 2 1 1 1 1 1 1 3 ...

$ Length.of.current.employment : int 2 3 4 3 3 2 4 2 1 1 ...

$ Instalment.per.cent : int 4 2 2 3 4 1 1 2 4 1 ...

$ Sex...Marital.Status : int 2 3 2 3 3 3 3 3 2 2 ...

$ Guarantors : int 1 1 1 1 1 1 1 1 1 1 ...

$ Duration.in.Current.address : int 4 2 4 2 4 3 4 4 4 4 ...

$ Most.valuable.available.asset : int 2 1 1 1 2 1 1 1 3 4 ...

$ Age..years. : int 21 36 23 39 38 48 39 40 65 23 ...

$ Concurrent.Credits : int 3 3 3 3 1 3 3 3 3 3 ...

$ Type.of.apartment : int 1 1 1 1 2 1 2 2 2 1 ...

$ No.of.Credits.at.this.Bank : int 1 2 1 2 2 2 2 1 2 1 ...

$ Occupation : int 3 3 2 2 2 2 2 2 1 1 ...

$ No.of.dependents : int 1 2 1 2 1 2 1 2 1 1 ...

$ Telephone : int 1 1 1 1 1 1 1 1 1 1 ...

$ Foreign.Worker : int 1 1 1 2 2 2 2 2 1 1 ...# remove NA

data_cr = na.omit(data_cr)

# quick summary

summary(data_cr) Creditability Account.Balance Duration.of.Credit..month.

Min. :0.0 Min. :1.000 Min. : 4.0

1st Qu.:0.0 1st Qu.:1.000 1st Qu.:12.0

Median :1.0 Median :2.000 Median :18.0

Mean :0.7 Mean :2.577 Mean :20.9

3rd Qu.:1.0 3rd Qu.:4.000 3rd Qu.:24.0

Max. :1.0 Max. :4.000 Max. :72.0

Payment.Status.of.Previous.Credit Purpose Credit.Amount

Min. :0.000 Min. : 0.000 Min. : 250

1st Qu.:2.000 1st Qu.: 1.000 1st Qu.: 1366

Median :2.000 Median : 2.000 Median : 2320

Mean :2.545 Mean : 2.828 Mean : 3271

3rd Qu.:4.000 3rd Qu.: 3.000 3rd Qu.: 3972

Max. :4.000 Max. :10.000 Max. :18424

Value.Savings.Stocks Length.of.current.employment Instalment.per.cent

Min. :1.000 Min. :1.000 Min. :1.000

1st Qu.:1.000 1st Qu.:3.000 1st Qu.:2.000

Median :1.000 Median :3.000 Median :3.000

Mean :2.105 Mean :3.384 Mean :2.973

3rd Qu.:3.000 3rd Qu.:5.000 3rd Qu.:4.000

Max. :5.000 Max. :5.000 Max. :4.000

Sex...Marital.Status Guarantors Duration.in.Current.address

Min. :1.000 Min. :1.000 Min. :1.000

1st Qu.:2.000 1st Qu.:1.000 1st Qu.:2.000

Median :3.000 Median :1.000 Median :3.000

Mean :2.682 Mean :1.145 Mean :2.845

3rd Qu.:3.000 3rd Qu.:1.000 3rd Qu.:4.000

Max. :4.000 Max. :3.000 Max. :4.000

Most.valuable.available.asset Age..years. Concurrent.Credits

Min. :1.000 Min. :19.00 Min. :1.000

1st Qu.:1.000 1st Qu.:27.00 1st Qu.:3.000

Median :2.000 Median :33.00 Median :3.000

Mean :2.358 Mean :35.54 Mean :2.675

3rd Qu.:3.000 3rd Qu.:42.00 3rd Qu.:3.000

Max. :4.000 Max. :75.00 Max. :3.000

Type.of.apartment No.of.Credits.at.this.Bank Occupation No.of.dependents

Min. :1.000 Min. :1.000 Min. :1.000 Min. :1.000

1st Qu.:2.000 1st Qu.:1.000 1st Qu.:3.000 1st Qu.:1.000

Median :2.000 Median :1.000 Median :3.000 Median :1.000

Mean :1.928 Mean :1.407 Mean :2.904 Mean :1.155

3rd Qu.:2.000 3rd Qu.:2.000 3rd Qu.:3.000 3rd Qu.:1.000

Max. :3.000 Max. :4.000 Max. :4.000 Max. :2.000

Telephone Foreign.Worker

Min. :1.000 Min. :1.000

1st Qu.:1.000 1st Qu.:1.000

Median :1.000 Median :1.000

Mean :1.404 Mean :1.037

3rd Qu.:2.000 3rd Qu.:1.000

Max. :2.000 Max. :2.000 - Let’s convert data types to as all of them are factors but some of them should be used as numeric

sapply(data_cr, class) Creditability Account.Balance

"integer" "integer"

Duration.of.Credit..month. Payment.Status.of.Previous.Credit

"integer" "integer"

Purpose Credit.Amount

"integer" "integer"

Value.Savings.Stocks Length.of.current.employment

"integer" "integer"

Instalment.per.cent Sex...Marital.Status

"integer" "integer"

Guarantors Duration.in.Current.address

"integer" "integer"

Most.valuable.available.asset Age..years.

"integer" "integer"

Concurrent.Credits Type.of.apartment

"integer" "integer"

No.of.Credits.at.this.Bank Occupation

"integer" "integer"

No.of.dependents Telephone

"integer" "integer"

Foreign.Worker

"integer" # Keep Duration.of.Credit..month and Credit.Amount as numeric rest to

# factors

id = c(1, 2, 4, 5, 7:21)

data_cr[id] = lapply(data_cr[id], as.factor)15.2 Visualisation some features

Create some visualisation to visualise data characteristics

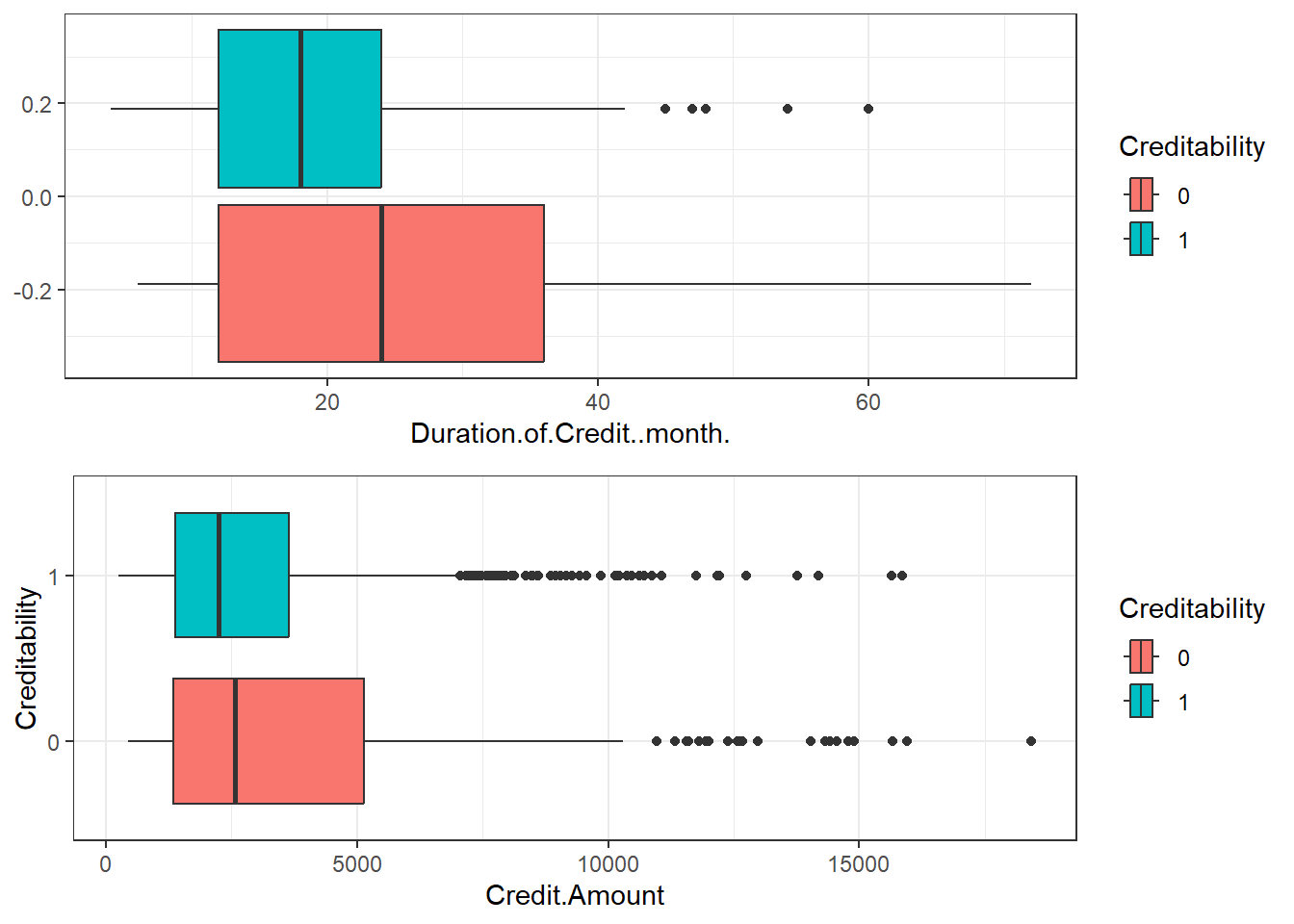

Box plots 15.1 for Duration of Credit and Credit Amount

library(ggplot2)

library(gridExtra)

# copy of data for plots

data_cr_p = data_cr

# set theme for the session

theme_set(theme_bw())

p1 = ggplot(data_cr, aes(Duration.of.Credit..month., fill = Creditability)) +

geom_boxplot()

p2 = ggplot(data_cr_p, aes(Credit.Amount, Creditability, fill = Creditability)) +

geom_boxplot()

grid.arrange(p1, p2, ncol = 1)

Figure 15.1: Box Plots

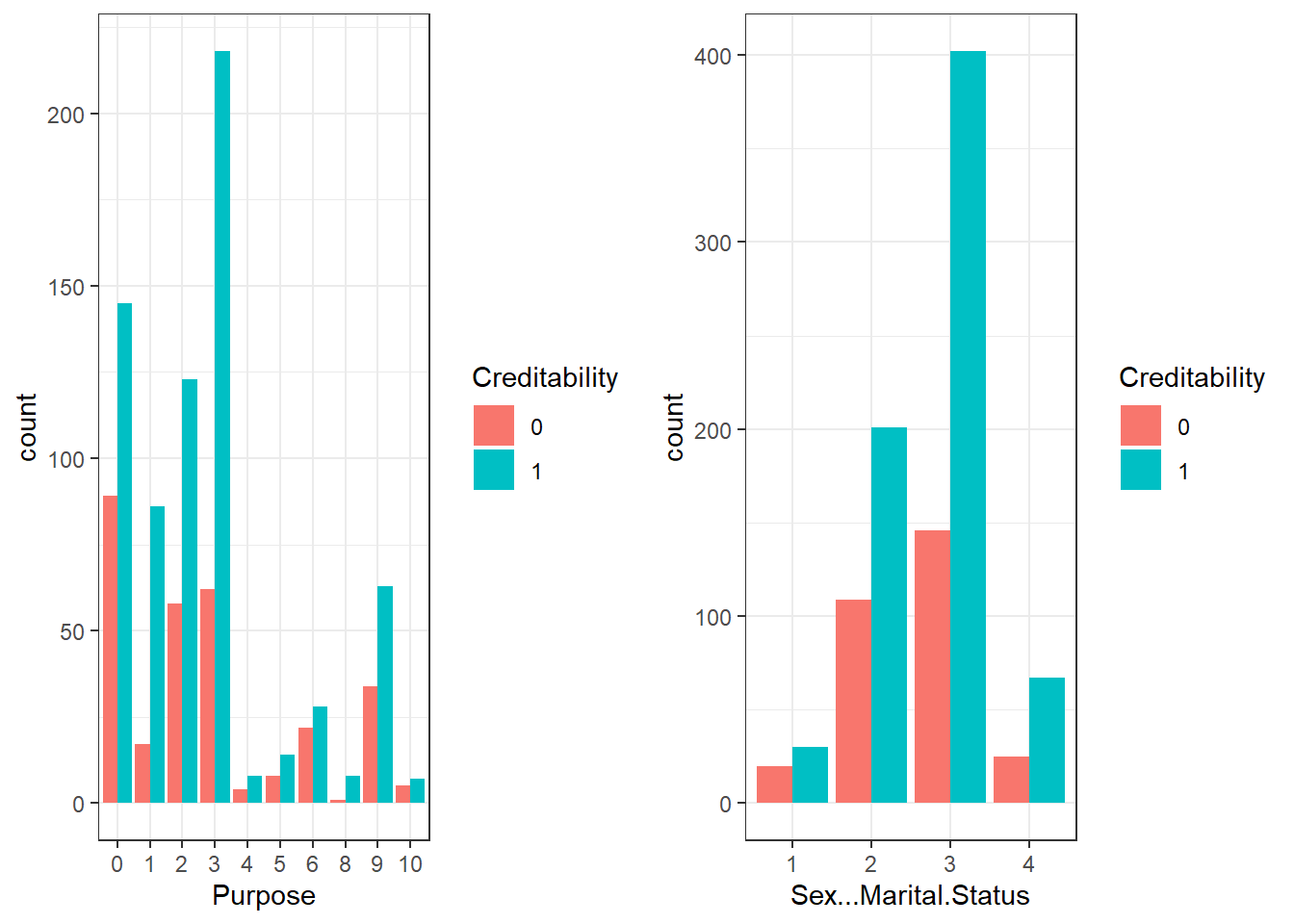

- See the relationship between Purpose, Sex/status and Creditability 15.2

p3 = ggplot(data_cr_p, aes(Purpose)) + geom_bar(aes(fill = Creditability),

stat = "count", position = "dodge")

p4 = ggplot(data_cr_p, aes(Sex...Marital.Status)) + geom_bar(aes(fill = Creditability),

stat = "count", position = "dodge")

grid.arrange(p3, p4, ncol = 2)

Figure 15.2: Bar plots

15.3 Creating Training and Testing Set and Control

- Use rsample package and stratified sampling

- Using mutliple cross validation for resampling

library(rsample)

library(caret)

set.seed(999) #for reproducibility (can pick your own seed, but keep it consistent)

idx = initial_split(data = data_cr, prop = 0.8, strata = "Creditability")

d_train1 = training(idx)

d_test1 = testing(idx)

prop.table(table(d_train1$Creditability))

0 1

0.3 0.7 prop.table(table(d_test1$Creditability))

0 1

0.3 0.7 cntrl1 = trainControl(method = "repeatedcv", number = 10, repeats = 2) #using repeated cross validate (repeating twice)15.4 Train the model on the training set

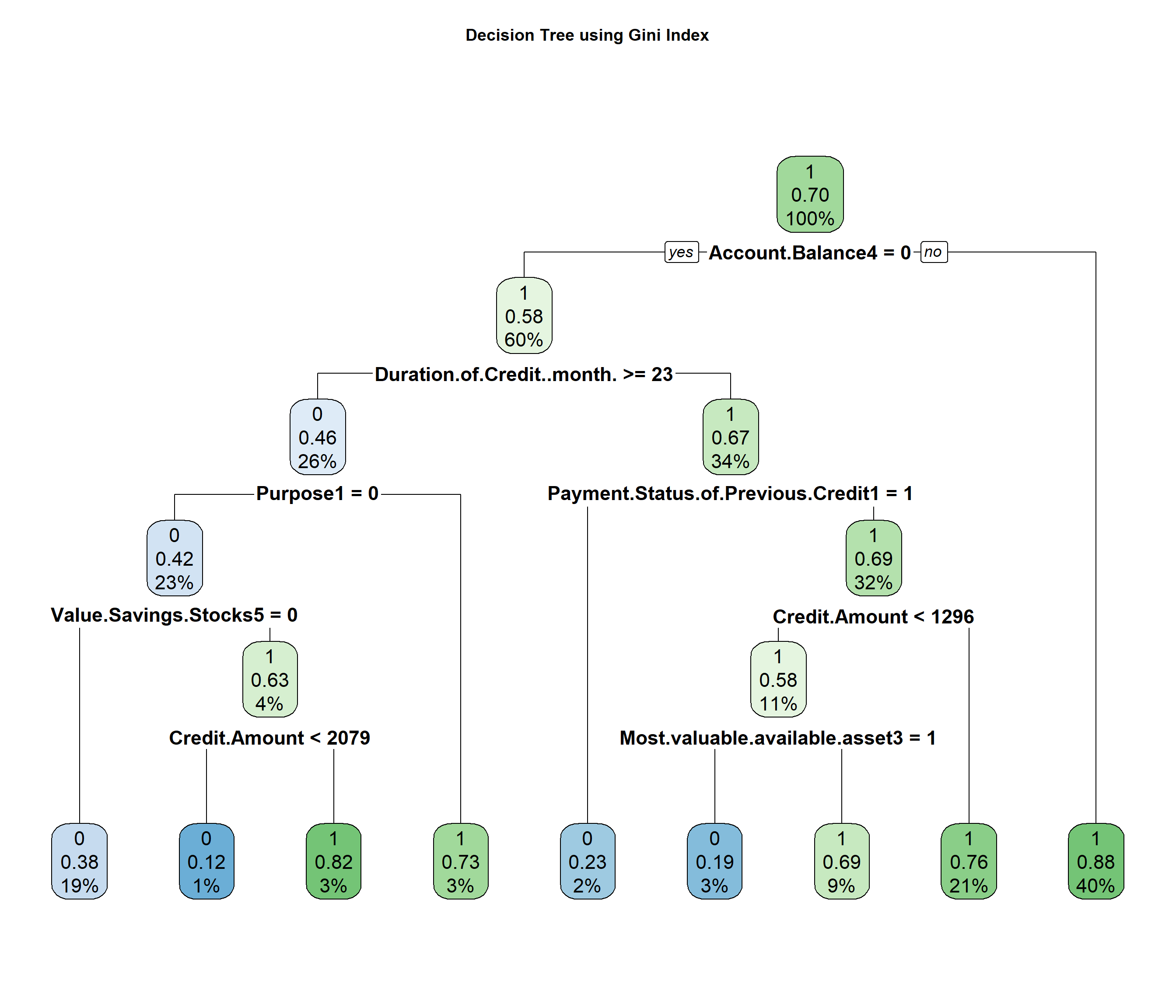

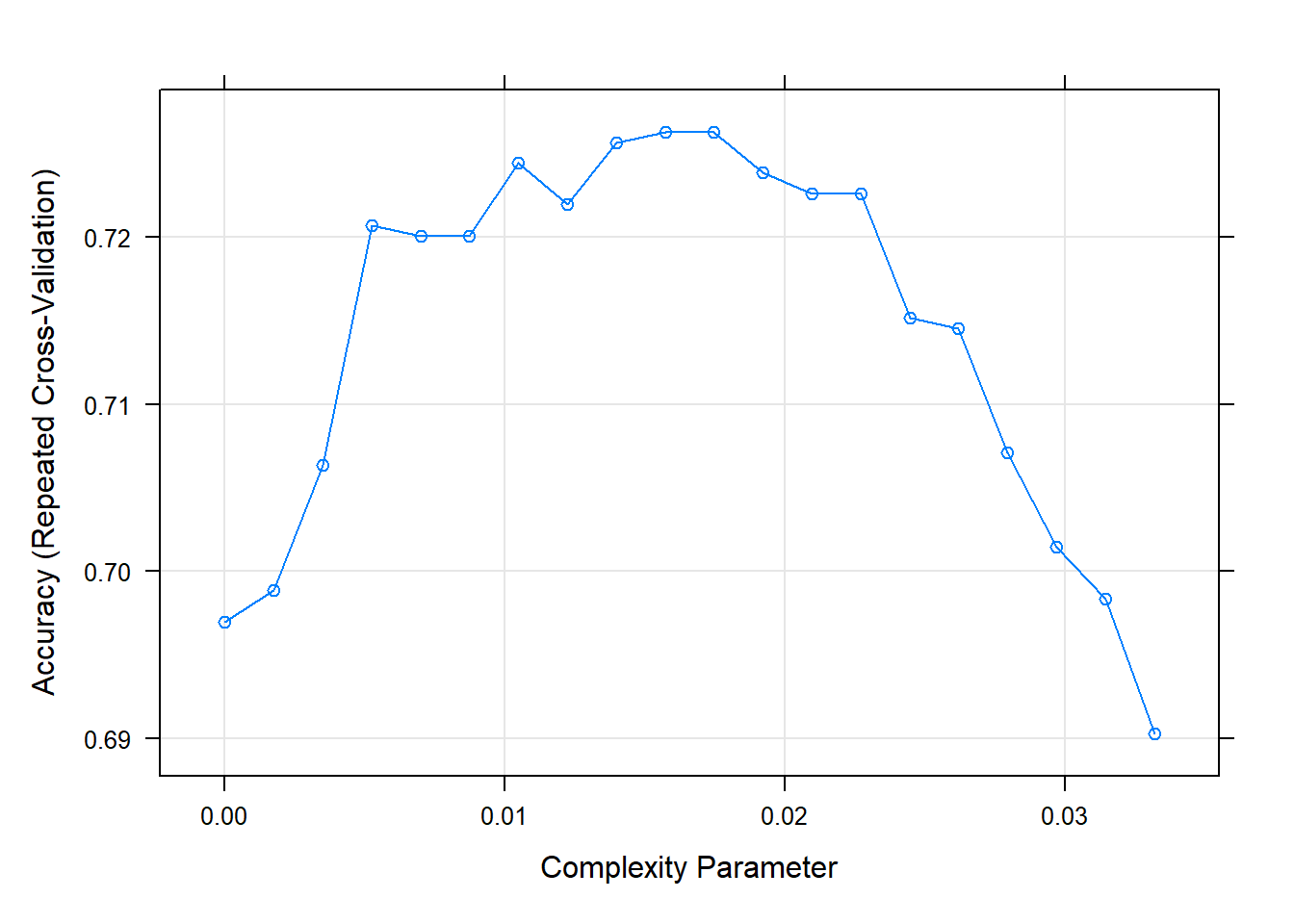

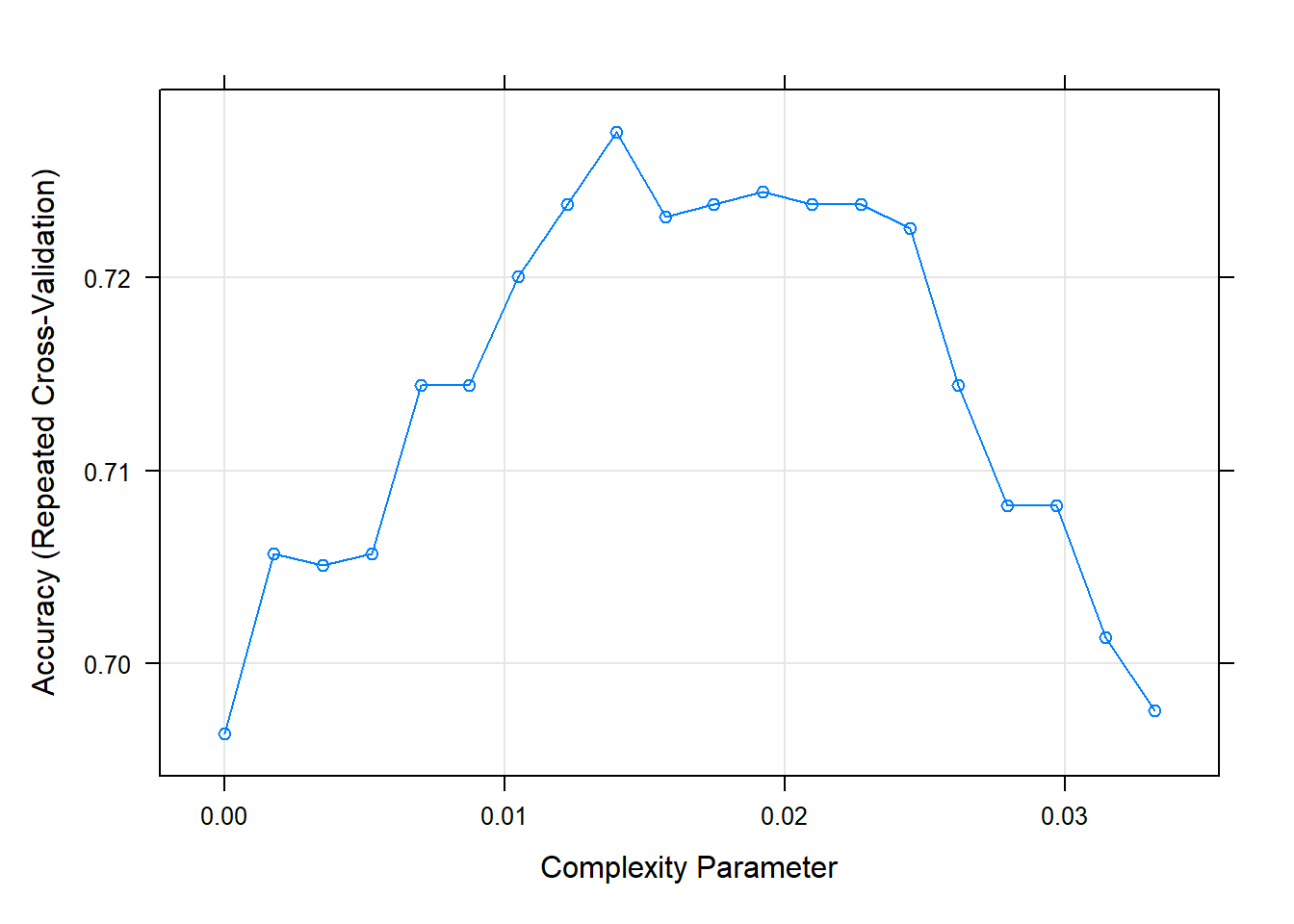

Use rpart package and caret package

The following block may results in slightly different results on individual computers. The fitted models are in data folder

set.seed(999) #for reproducibility

cv_tree1 = train(Creditability ~ ., data = d_train1, trControl = cntrl1,

method = "rpart", tuneLength = 20, parms = list(split = "gini")) #using gini index

cv_tree2 = train(Creditability ~ ., data = d_train1, trControl = cntrl1,

method = "rpart", tuneLength = 20, parms = list(split = "information")) #using information The fitted models were saved afterwards as cv_tree1_gini.Rdata and cv_tree2_info.Rdata

Loading the fitted models to analyse

set.seed(999)

load("data/cv_tree1_gini.Rdata")

load("data/cv_tree2_info.Rdata")

# model fit 1

cv_tree1CART

802 samples

20 predictor

2 classes: '0', '1'

No pre-processing

Resampling: Cross-Validated (10 fold, repeated 2 times)

Summary of sample sizes: 721, 722, 722, 722, 722, 721, ...

Resampling results across tuning parameters:

cp Accuracy Kappa

0.000000000 0.6969830 0.2512465

0.001747106 0.6988580 0.2543412

0.003494213 0.7063349 0.2628946

0.005241319 0.7206867 0.2861502

0.006988425 0.7200540 0.2777666

0.008735532 0.7200617 0.2727974

0.010482638 0.7244367 0.2758523

0.012229744 0.7219444 0.2739317

0.013976851 0.7256636 0.2964605

0.015723957 0.7262886 0.2940382

0.017471064 0.7262886 0.2936297

0.019218170 0.7238272 0.2881274

0.020965276 0.7225926 0.2839374

0.022712383 0.7225926 0.2839374

0.024459489 0.7151466 0.2534916

0.026206595 0.7145370 0.2595461

0.027953702 0.7070833 0.2284884

0.029700808 0.7014583 0.2203101

0.031447914 0.6983565 0.1916670

0.033195021 0.6902701 0.1609005

Accuracy was used to select the optimal model using the largest value.

The final value used for the model was cp = 0.01747106.# model fit 2

cv_tree2CART

802 samples

20 predictor

2 classes: '0', '1'

No pre-processing

Resampling: Cross-Validated (10 fold, repeated 2 times)

Summary of sample sizes: 721, 722, 722, 722, 721, 722, ...

Resampling results across tuning parameters:

cp Accuracy Kappa

0.000000000 0.6963735 0.2470114

0.001747106 0.7056867 0.2628565

0.003494213 0.7050849 0.2532738

0.005241319 0.7056867 0.2530103

0.006988425 0.7144290 0.2708436

0.008735532 0.7144290 0.2715985

0.010482638 0.7200540 0.2804530

0.012229744 0.7237654 0.2784178

0.013976851 0.7275154 0.2885322

0.015723957 0.7231404 0.2833342

0.017471064 0.7237731 0.2843818

0.019218170 0.7243981 0.2782958

0.020965276 0.7237886 0.2732868

0.022712383 0.7237886 0.2732868

0.024459489 0.7225386 0.2708625

0.026206595 0.7144136 0.2456549

0.027953702 0.7082022 0.2211492

0.029700808 0.7082022 0.2211492

0.031447914 0.7013580 0.1774435

0.033195021 0.6976080 0.1496378

Accuracy was used to select the optimal model using the largest value.

The final value used for the model was cp = 0.01397685.plot(cv_tree1) #parameter search using gini

plot(cv_tree2) #parameter search using information

15.5 Prediction and Accuracy

- Using testing set and confusion matrix to compare accuracies

15.5.1 Model-1

pred1 = predict(cv_tree1, newdata = d_test1)

confusionMatrix(pred1, d_test1$Creditability)Confusion Matrix and Statistics

Reference

Prediction 0 1

0 33 10

1 27 130

Accuracy : 0.815

95% CI : (0.7541, 0.8663)

No Information Rate : 0.7

P-Value [Acc > NIR] : 0.0001479

Kappa : 0.5207

Mcnemar's Test P-Value : 0.0085289

Sensitivity : 0.5500

Specificity : 0.9286

Pos Pred Value : 0.7674

Neg Pred Value : 0.8280

Prevalence : 0.3000

Detection Rate : 0.1650

Detection Prevalence : 0.2150

Balanced Accuracy : 0.7393

'Positive' Class : 0

15.5.2 Model-2

pred2 = predict(cv_tree2, newdata = d_test1)

confusionMatrix(pred2, d_test1$Creditability)Confusion Matrix and Statistics

Reference

Prediction 0 1

0 32 9

1 28 131

Accuracy : 0.815

95% CI : (0.7541, 0.8663)

No Information Rate : 0.7

P-Value [Acc > NIR] : 0.0001479

Kappa : 0.5157

Mcnemar's Test P-Value : 0.0030846

Sensitivity : 0.5333

Specificity : 0.9357

Pos Pred Value : 0.7805

Neg Pred Value : 0.8239

Prevalence : 0.3000

Detection Rate : 0.1600

Detection Prevalence : 0.2050

Balanced Accuracy : 0.7345

'Positive' Class : 0